Randomly and variously and not so randomly and not so variously. In moments a random and various archive of things of interest to randomly.variously. In other moments, a random and various archive of random and various thoughts. If you find yourself moving similarly randomly.variously do contribute otherwise, this isn't a popularity contest or race, so just push off and move on randomly and variously in your own fashion.

Friday, August 7, 2015

Monday, August 3, 2015

Ancient Wisdom vs. Modern Wisdom, Or A Short History of Debt

The idea of wiping all debt, of resetting all the clocks, seems to be front and center today (or for conservative readers, perhaps I should say "left of center")

In popular culture, debt relief it is the major theme of the excellent new series Mr. Robot.

The show is roughly about a hacker group known as fsociety (F*** Society?) trying to take down the computer servers that power the world's largest corporation E-Corp (E=Evil) as a way to wipe all the records of debt that they hold and push the reset button for society.

The topic of debt, debt relief and the future of society (in this case the European Union) is also in the news everyday. Some see the heart of the drama in the German rightful wagging of their fingers at Greek call for debt-relief, some the heart of the drama in the Germans falling once again into historical amnesia. After all, didn't the Germans benefit from the 1953 agreement which "effectively cut West Germany's post-World War II debt in half."

As the NYT points out: "Nobody should understand this better than the Germans. It’s not just that they benefited from the deal in 1953, which underpinned Germany’s postwar economic miracle" which included high-fashion and hula-hoops

The story here continues on to say, that the Germans should remember that it was debt forgiveness that allowed them to refocus on rebuilding their economy, a forgiveness which they seem to want to deny the Greeks. And with a little more reflection, the story goes, Germany could probably remember much much more: "After enduring years of price controls and Nazi-imposed rationing, new disposable income of the period suddenly allowed Germans to purchase cars, ovens, washing machines—modern status symbols that grew fashionable as West Germany became one of the richest countries in the world. “People had the feeling things were improving; that they could achieve something...People found joy in life again.” Source

"Twenty years earlier, Germany defaulted on its debts from World War I, after undergoing a bout of hyperinflation and economic depression that helped usher Hitler to power. It is a general lesson about the nature of debt. Yet from the World War I defaults of more than a dozen countries in the 1930s to the Brady write-downs of the early 1990s, which ended a decade of high debt and no growth in Latin America and other developing countries, it is a lesson that has to be relearned again and again. The recurring, historical pattern? Major debt overhangs are only solved after deep write-downs of the debt’s face value. The longer it takes for the debt to be cut, the bigger the necessary write-down will turn out to be." Source

Other versions of the debt story focus on, the staggering student debt crisis in the US. Some suggest that the truest story of debt is to be found in the bible:

As Evangelist Franklin Graham tells it: "In life, we all owe a debt we can't pay and need forgiveness. The Bible says, 'The wages of sin is death.' But Jesus Christ came to earth to die on a cross and pay the price for our sins, and God raised Him to life—making forgiveness and eternal life available to all mankind. That's what I call complete debt forgiveness! Do you have it?" he asked his followers."

As the German example of the debt story shows, some historical perspective can be immensely helpful. An eight-minute version of the history debt and debt relief can be found Michael Hudson's documentary Surviving Progress:

To say its a version of the story, is not intended as a discrediting remark, but rather intended as a qualifying comment -after all, if can reduce thousands of years of history into eight minutes you have to leave an enormous amount of important detail out of the story. In any event, the eight-minute "Short history of debt" is itself thought provoking. Below is a transcript excerpt from Michael Hudson's documentary "Surviving Progress." The entire transcript can be found here. The film can be purchased here. The documentary is also currently available on Netflix.

A Short History of Debt

A Short History of Debt

Written records go back about 4,000 years, and from 2,000 BC to the time of Jesus, it was normal for all of the countries in the world to periodically cancel the debts when they became too large to pay.

So you have Sumer, Babylonia, Egypt, other regions all proclaiming these debt cancellations and the effect was to make a clean slate so that society would begin all over again.

This was easy to do in a society where most debts were owed to the State.

It became much harder to do, when enterprise and credit passed out of the hands of the state into private hands, into the hands of an oligarchy.

And the last thing they wanted was to have a king that would actually cancel the debts and restore equality.

Rome was the first country of the world not to cancel the debts.

It went to war in Sparta, in Greece, to overthrow the governments and the kings that wanted to cancel the debts.

The wars of the first century BC ended up stripping these countries of everything they had, not only did it strip the temples of gold, it stripped the public buildings, it stripped the economies of their reproductive capacity, it stripped them of their waterworks, it made a desert out of the land.

And it said a debt is a debt.

The collapse seems to have been closely linked to ecological devastation which led to all sorts of social and economic and military problems.

In the early stages of the Roman Republic, you had fairly egalitarian land owning systems, the peasants had access to public land, but as the Roman State became more powerful and the lords and the generals began to appropriate public land for their own private estates, more and more peasants became landless.

At the same time, erosion was a serious problem, so bad that some of the Roman ports silted up with all the topsoil that got washed down from the fields into the river, and archeologists have been able to establish how badly degraded much of Italy was by the fall of the Roman Empire and how it took a thousand years of much reduced population during the Middle Ages for fertility in Italy to rebuild.

Debt Cancellation in Mesopotamia and Egypt from 3000 to 1000 BC

Source: http://www.globalresearch.ca/debt-cancellation-in-mesopotamia-and-egypt-from-3000-to-1000-bc/5303136

We must pierce the smoke-screen of creditors and re-establish the historical truth. Repeated and generalised debt cancellation has occurred throughout history.

Hammurabi, king of Babylon, and debt cancellation

The Hammurabi Code is in the Louvre Museum, in Paris. The term “code” is inappropriate, because what Hammurabi left us is a set of rules and judgements on relations between public authorities and citizens. Hammurabi began his 42-year reign as “king” of Babylon (located in present-day Iraq), in 1792 BC. What most history books fail to mention is that, like other governors of the City-State of Mesopotamia, Hammurabi proclaimed the official cancellation of citizens’ debts owed to the government, high-ranking officials, and dignitaries. The so-called Hammurabi Code is thought to date back to 1762 BC. Its epilogue proclaims that “the powerful may not oppress the weak; the law must protect widows and orphans (…) in order to bring justice to the oppressed”. The many ancient documents deciphered from cuneiform script have enabled historians to establish beyond any doubt that four general cancellations took place during Hammurabi’s reign, in 1792, 1780, 1771, and 1762 BC.

In Hammurabi’s time, economic, political, and social life were organised around the Temple and the Palace. Those two closely enmeshed institutions, with their numerous artisans, workers, and, of course, scribes, constituted the apparatus of the State, not so very different from today’s governments. The Temple and the Palace provided their employees with board and lodge: they thus received food rations sufficient for two full meals a day. The peasantry was provided with land (which they rented), tools, draught animals, livestock, and water for irrigation, so that they could grow food for the workers and dignitaries. Thus, the peasants produced barley (their staple grain), oil, fruit, and vegetables, a portion of which, when harvested, they had to pay to the State as rent. As well as the land they cultivated for the Palace and the Temple, the peasants owned their own land, home, livestock, and tools. When the harvest was poor, they accumulated debts. They also incurred debt through loans granted privately by high-ranking officials and dignitaries eager to get rich and to seize the peasants’ property in case of default. If peasants were unable to pay off their debts, they could also find themselves reduced to the condition of serfs or slaves; indebtedness could also lead to members of their family being made slaves. In order to ensure social peace and stability, and especially to prevent peasants’ living conditions from deteriorating, the authorities periodically cancelled all debt |1| and restored peasants’ rights.

General debt cancellations in Mesopotamia over 1000 years

Proclamations of general debt cancellation began long before Hammourabi’s reign and continued afterwards. There is evidence of debt cancellation as far back as 2400 BC, six centuries before Hammurabi’s reign, in the city of Lagash (Sumer). The most recent instance dates back to 1400 B.C. in Nuzi. In all, historians have identified with certainty about thirty general debt cancellations in Mesopotamia from 2400 to 1400 BC. Michael Hudson |2| is right to claim that general debt cancellation was one of the principal characteristics of Bronze Age societies in Mesopotamia. Indeed, there are various Mesopotamian words for these cancellations, which wiped the slate clean: amargi in Lagash (Sumer), nig-sisa in Ur, andurarum in Ashur, misharum in Babylon, shudutu in Nuzi.

Such proclamations of debt cancellation were an occasion for great festivities, usually at the annual celebration of Spring. It was during the dynasty of Hammurabi’s family that the tradition of destroying the tablets upon which the debts were inscribed was inaugurated — the public authorities kept a strict record of debts on tablets conserved in the Temple. When Hammurabi died in 1749 BC after a reign of 42 years, his successor, Samsuiluna, cancelled all debts to the State, and decreed that all tablets should be destroyed except those concerning traders’ debts.

The general debt cancellation proclaimed by Ammisaduqa, the last governor of the Hammurabi dynasty who came to the throne in 1646 BC, was very detailed, in a clear attempt to prevent creditors from taking advantage of loopholes. The cancellation decree specified that official creditors and tax collectors who had expropriated peasants should compensate them and return their property, on pain of execution. In cases where a creditor had taken some item of property using pressure, unless he gave it back and/or repaid its worth in full, he would be put to death.

In the wake of this decree, commissions were set up to review all real estate contracts and to eliminate all those which fell under the terms of the debt cancellation proclamation with a view to restoring the prior situation, statu quo ante. The enactment of this decree was facilitated by the fact that the despoiled peasants were usually still working the land, even though it was owned by the creditor. Thus, by cancelling the contracts and making the creditors indemnify the victims, the public authorities restored peasants’ rights. A little over two centuries later, the situation was to change for the worse.

The limits of debt cancellation

In Mesopotamia, during the Bronze Age, debt-slaves were freed, unlike other types of slave such as those seized at war. Nevertheless, this debt cancellation must not be presented as if it were a form of social emancipation. It was merely a way of restoring the pre-existing social order, which was rife with forms of oppression. Without wishing to embellish the organisation of these societies of 3000 to 4000 years ago, it should be noted nonetheless that their rulers sought to maintain social cohesion by preventing the constitution of big private domains, and took measures to ensure that peasants enjoyed direct access to the land. They limited the rise of inequality while overseeing the development and maintenance of irrigation systems. Michael Hudson also insists that any decision to declare war was taken by a general assembly of citizens – the “king” did not have the power to make such decisions alone.

It seems that Bronze Age Mesopotamians did not believe in divine creation as the explanation for life on Earth. The ruler, confronted with chaos, reorganised the world to establish normal order and justice.

No further act of debt cancellation has been found for the period after 1400 BC; inequality increased and intensified. Land was taken over by big private land-owners and debt enslavement became commonplace. A large part of the population migrated north-west towards Canaan, with incursions into Egypt, which displeased the Pharaohs.

The ensuing centuries are known by historians of Mesopotamia as the “Dark Ages”, because of the dearth of written records. However, we do have evidence of violent social struggles between creditors and debtors.

Egypt: the Rosetta Stone confirms the tradition of debt cancellation

The Rosetta Stone, which was carried off by some of Napoleon’s army in 1799 during his Egyptian Campaign, was deciphered in 1822 by Jean-François Champollion. Today, it is in the British Museum in London. Its translation was facilitated by the fact that the Stone bears the same text in three languages: Ancient Egyptian, Egyptian demotic, and the Greek of Alexander the Great’s era.

The Rosetta Stone text confirms that the tradition of debt cancellation was upheld in Egypt by the pharaohs from the 8th century B.C., before Alexander the Great conquered the country in the 4th century B.C. It relates that the pharaoh Ptolemeus V cancelled all debt due to the Throne by the people of Egypt and beyond, in 196 BC.

Despite great differences between the society of Pharaonic Egypt and that of Bronze Age Mesopotamia, there is evidence that both had a tradition of proclaiming amnesty before general debt cancellation. Ramses IV (1153-1146 BC) proclaimed that those who had fled the country could return, and that those who were in prison should be freed. His father, Ramses III (1184 –1153 BC) had done the same. Note that in the 2nd millennium BC there does not seem to have been debt enslavement in Egypt: all slaves were war booty. The proclamations made by Ramses III and Ramses IV concerned the cancellation of arrears on taxes owed to the pharaoh, the liberation of political prisoners and the possibility for those in exile to return home.

Not until the 8th century BC do we find, for Egypt, proclamations of debt cancellation and of liberation for debt slaves. Such a proclamation was made by the Pharaoh Bocchoris (717-11 BC).

One of the fundamental motives for debt cancellation was that the pharaoh wanted at his disposal a peasantry able both to produce plenty of food and to take up arms in military campaigns. For these two reasons, it was important to prevent peasants from being expropriated by creditors.

In neighbouring Assyria, the emperors of the 1st millennium BC also adopted the tradition of debt cancellation, as did the rulers of Jerusalem in the 5th century BC: in 432 BC Nehemiah, no doubt influenced by the old Mesopotamian tradition, proclaimed the cancellation of the debts of all Jews who owed money to their wealthy compatriots. This was at the very time when the Torah was being written. The tradition of general debt cancellation is an integral part of the Jewish religion and of early Christian texts, via the Book of Leviticus, which proclaims the obligation to cancel debt every seven years and on every jubilee, that is, every fifty years.

Conclusion

In the present day, debt repayment has become a taboo subject. Heads of State and of governments, central banks, the IMF and the mass media, all present it as though it were inevitable, unquestionable, and obligatory. Citizens must resign themselves to paying off the debt. The only discussion possible focuses on how to distribute the burden of sacrifice needed in order to free up enough budgetary resources to fulfil the commitments of the indebted nation. The governments who have borrowed were elected democratically, goes the reasoning, therefore their actions are legitimate. The debt must be paid off.

We must pierce the smoke-screen of creditors and re-establish the historical truth. Generalised debt cancellations have been enacted repeatedly throughout history. These cancellations correspond to different contexts. In the cases mentioned above, proclamations of general debt cancellation were made at the initiative of rulers concerned with upholding social peace. In some cases, cancellations resulted from social struggles exacerbated by economic crisis and the rise of inequality. This was the case in Ancient Greece and Rome. Other scenarii can also be envisaged, such as debt cancellation decreed by indebted countries that decide to take unilateral sovereign action, and debt cancellation conceded by a victorious country to a vanquished one and/or its allies. One thing is certain: historically speaking debt has always played a major role in social and political upheaval.

Translated by Vicki Briault and Charles La Via.

notes articles:

|1| Debts between traders were not concerned by these cancellations.

|2| This article is mainly based on the historical synthesis presented by Michael Hudson, doctor in economics, in several fascinating articles and books including: “The Lost Tradition of Biblical Debt Cancellations”, 1993, 87 pages; “The Archeology of Money”, 2004. Michael Hudson is part of a multi-discipline scientific team (ISCANEE, International Scholars’ Conference on Ancient Near Eastern Economies) comprising a number of philologists, archaeologists, historians and economists working on the ancient societies and economies of the Near East. Their findings are published by Harvard University. Michael Hudson approaches this work as an extension of the research carried out by Karl Polanyi. He also produces analyses on the current crisis. See for example “The Road to Debt Deflation, Debt, Peonage, and Neoliberalism”, February 2012, 30 p. Among works by other authors who, since the economic and financial crisis that began in 2007-2008, have written about the long tradition of debt cancellation: David Graeber, “Debt: The First 5000 Years”, Melvillehouse, New York, 2011, 542 p.

infos article

URL: http://www.cadtm.orgEric Toussaint (doctor in political science, president of CADTM Belgium www.cadtm.org, member of the Scientific Council of ATTAC France).

Damien Millet and Eric Toussaint directed the collective work “La Dette ou La Vie”, Aden, CADTM, 2011, which received the Political Book Award at the Liège Political Book Fair in 2011. Most recent publication: Damien Millet and Eric Toussaint, “AAA, Audit, Annulation, Autre Politique”, Le Seuil, Paris, 2012.

http://www.globalresearch.ca/debt-cancellation-in-mesopotamia-and-egypt-from-3000-to-1000-bc/5303136

Forgive All Debt-Push The Reset Button and Fix Our Economy - Student Loans and Mortgages

By Liberty1955 | Posted October 16, 2012 | Watertown, New York 1

Source: http://ireport.cnn.com/docs/DOC-859125

Happy days could be here again! Forgive all personal debt!"Oh, you're crazy, Liberty! No one's going to do that. How would that help anything?"

What would you buy if your FICO score was 825?

What home repair would you finance if you suddenly weren't under water on your mortgage?

In fact, what could you afford to do if you owned your home outright?

Banks created complex ponzi schemes called CDOs and Mortgage backed securities to extract cash from homeowners.

Our economy collapsed, they got bailed out and homeowners got stuck with the bill.

Was this fair?

Banks should cough up the cash that they stole.

And make no mistake, it was stolen. We're not using euphemisms in this report.

Lying is lying not 'exaggerating the truth'.

And stealing is stealing from homeowners by banks. Read Congress's report if you doubt this still.

So give the money back. Push the reset button on debt.

Why should the con men get to keep their rewards?

Early civilizations did just this and it worked well.

We must:

"make certain that capital remain the handmaiden of the state and not fancy itself the mistress of the nation." - Hitler

The international financial system is nobody's friend.

We have to find some way to control it so we can get on with our lives.

Second Millennium Ur may have been an early hothouse of capitalistic enterprise, but what of the borrowers mired in debt?

http://en.wikipedia.org/wiki/Ur

"Governments may actually prefer people in debt.

A study by the economist M. Darling of the rural economy of the Punjab in modern times suggests a disturbing thing about human nature -- people work harder and produce more when they are in debt."

Do countries?

"Darling found that crop yields for farmers in debt typically exceeded yields from unencumbered farmers.

Farmers in the Punjab may have faced foreclosure, but for the ancient inhabitant of Ur, the motivation was even greater.

Debtors were often forced to sell themselves into slavery."

This is where we are now.

"It is difficult to escape the conclusion that, while the first loan contracts and the legal system that enforced them may have been good for the Mesopotamian economy, they made life miserable for the working man and woman.

If lending began, as historian Paul Millet believes, as a process of neighborly reciprocity in rural societies, then it evolved into something quite different.

In Babylonian times, short-term debt was a tool used to extract taxes from the population, and to increase the productivity of temple lands.

It is almost as though the government had found a way to extract the residual "goodwill" from the economy, by allowing individuals to shift financial obligations into the future.

Lending in ancient Ur was mostly for emergency purposes -- where the government created the emergency!

The other side of the coin is that certain entrepreneurs such as Dumuzi-gamil achieved economic upward mobility through borrowing.

Thus, while the system was harsh on the populace, it encouraged creative and productive enterprise.

For those with the imagination to exploit it, the financial system of Ur offered limitless possibilities.

Does this sound familiar? It was more than 3,000 years ago.

The premise of national socialism is that it is possible to get out of this.

The way to get out of the system of debt slavery is to use enthusiasm instead of fear to motivate people."

Hitler was a maniac, a a brilliant strategist whose economic policies lead Germany out of their depression to the most powerful economic country in Europe in four short years. He designed 'national socialism'.

"The Mesopotamian economy was dominated by large public institutions (Temples and Palaces) whose bureaucratic administrators effectively created money of account by establishing a fixed equivalent between silver and the staple crop, barley. Debts were calculated in silver, but silver was rarely used in transactions.

Instead, payments were made in barley or in anything else that happened to be handy and acceptable. Major debts were recorded on cuneiform tablets kept as sureties by both parties to the transaction.

Certainly, markets did exist. Prices of certain commodities that were not produced within Temple or Palace holdings, and thus not subject to administered price schedules, would tend to fluctuate according to the vagaries of supply and demand.

But most actual acts of everyday buying and selling, particularly those that were not carried out between absolute strangers, appear to have been made on credit.

"Ale women", or local innkeepers, served beer, for example, and often rented rooms; customers ran up a tab; normally, the full sum was dispatched at harvest time.

Market vendors presumably acted as they do in small-scale markets in Africa, or Central Asia, today, building up lists of trustworthy clients to whom they could extend credit.

The habit of money at interest also originates in Sumer – it remained unknown, for example, in Egypt. Interest rates, fixed at 20 percent, remained stable for 2,000 years. (This was not a sign of government control of the market: at this stage, institutions like this were what made markets possible.)

This, however, led to some serious social problems. In years with bad harvests especially, peasants would start becoming hopelessly indebted to the rich, and would have to surrender their farms and, ultimately, family members, in debt bondage.

Gradually, this condition seems to have come to a social crisis – not so much leading to popular uprisings, but to common people abandoning the cities and settled territory entirely and becoming semi-nomadic "bandits" and raiders.

It soon became traditional for each new ruler to wipe the slate clean, cancel all debts, and declare a general amnesty or "freedom", so that all bonded labourers could return to their families.

(It is significant here that the first word for "freedom" known in any human language, the Sumerian amarga, literally means "return to mother".)

Biblical prophets instituted a similar custom, the Jubilee, whereby after seven years all debts were similarly canceled.

This is the direct ancestor of the New Testament notion of "redemption".

(Bankruptcy laws used to forgive debt until they were changed to exclude what would hurt banks and governments)

Historically, as we have seen, ages of virtual, credit money have also involved creating some sort of overarching institutions – Mesopotamian sacred kingship, Mosaic jubilees, Sharia or Canon Law – that place some sort of controls on the potentially catastrophic social consequences of debt.

Almost invariably, they involve institutions (usually not strictly coincident to the state, usually larger) to protect debtors.

So far the movement this time has been the other way around: starting with the '80s we have begun to see the creation of the first effective planetary administrative system, operating through the IMF, World Bank, corporations and other financial institutions, largely in order to protect the interests of creditors.

The question is how we can create a countervailing force to oppose this "planetary administrative system."

If we find the will to do what has been done in the past, forgive everyone's debt, we would fix our economy and 'heal the planet'.

Just like when your computer freezes, sometimes the only recourse is to push the reset button.

Or, we can languish in slow growth for the next decade or two.

http://www.geniebusters.org/what-is-national-socialism.htm

In popular culture, debt relief it is the major theme of the excellent new series Mr. Robot.

The show is roughly about a hacker group known as fsociety (F*** Society?) trying to take down the computer servers that power the world's largest corporation E-Corp (E=Evil) as a way to wipe all the records of debt that they hold and push the reset button for society.

The topic of debt, debt relief and the future of society (in this case the European Union) is also in the news everyday. Some see the heart of the drama in the German rightful wagging of their fingers at Greek call for debt-relief, some the heart of the drama in the Germans falling once again into historical amnesia. After all, didn't the Germans benefit from the 1953 agreement which "effectively cut West Germany's post-World War II debt in half."

As the NYT points out: "Nobody should understand this better than the Germans. It’s not just that they benefited from the deal in 1953, which underpinned Germany’s postwar economic miracle" which included high-fashion and hula-hoops

The story here continues on to say, that the Germans should remember that it was debt forgiveness that allowed them to refocus on rebuilding their economy, a forgiveness which they seem to want to deny the Greeks. And with a little more reflection, the story goes, Germany could probably remember much much more: "After enduring years of price controls and Nazi-imposed rationing, new disposable income of the period suddenly allowed Germans to purchase cars, ovens, washing machines—modern status symbols that grew fashionable as West Germany became one of the richest countries in the world. “People had the feeling things were improving; that they could achieve something...People found joy in life again.” Source

Other versions of the debt story focus on, the staggering student debt crisis in the US. Some suggest that the truest story of debt is to be found in the bible:

As Evangelist Franklin Graham tells it: "In life, we all owe a debt we can't pay and need forgiveness. The Bible says, 'The wages of sin is death.' But Jesus Christ came to earth to die on a cross and pay the price for our sins, and God raised Him to life—making forgiveness and eternal life available to all mankind. That's what I call complete debt forgiveness! Do you have it?" he asked his followers."

As the German example of the debt story shows, some historical perspective can be immensely helpful. An eight-minute version of the history debt and debt relief can be found Michael Hudson's documentary Surviving Progress:

To say its a version of the story, is not intended as a discrediting remark, but rather intended as a qualifying comment -after all, if can reduce thousands of years of history into eight minutes you have to leave an enormous amount of important detail out of the story. In any event, the eight-minute "Short history of debt" is itself thought provoking. Below is a transcript excerpt from Michael Hudson's documentary "Surviving Progress." The entire transcript can be found here. The film can be purchased here. The documentary is also currently available on Netflix.

Written records go back about 4,000 years, and from 2,000 BC to the time of Jesus, it was normal for all of the countries in the world to periodically cancel the debts when they became too large to pay.

So you have Sumer, Babylonia, Egypt, other regions all proclaiming these debt cancellations and the effect was to make a clean slate so that society would begin all over again.

This was easy to do in a society where most debts were owed to the State.

It became much harder to do, when enterprise and credit passed out of the hands of the state into private hands, into the hands of an oligarchy.

And the last thing they wanted was to have a king that would actually cancel the debts and restore equality.

Rome was the first country of the world not to cancel the debts.

It went to war in Sparta, in Greece, to overthrow the governments and the kings that wanted to cancel the debts.

The wars of the first century BC ended up stripping these countries of everything they had, not only did it strip the temples of gold, it stripped the public buildings, it stripped the economies of their reproductive capacity, it stripped them of their waterworks, it made a desert out of the land.

And it said a debt is a debt.

The collapse seems to have been closely linked to ecological devastation which led to all sorts of social and economic and military problems.

In the early stages of the Roman Republic, you had fairly egalitarian land owning systems, the peasants had access to public land, but as the Roman State became more powerful and the lords and the generals began to appropriate public land for their own private estates, more and more peasants became landless.

At the same time, erosion was a serious problem, so bad that some of the Roman ports silted up with all the topsoil that got washed down from the fields into the river, and archeologists have been able to establish how badly degraded much of Italy was by the fall of the Roman Empire and how it took a thousand years of much reduced population during the Middle Ages for fertility in Italy to rebuild.

Debt Cancellation in Mesopotamia and Egypt from 3000 to 1000 BC

Source: http://www.globalresearch.ca/debt-cancellation-in-mesopotamia-and-egypt-from-3000-to-1000-bc/5303136

We must pierce the smoke-screen of creditors and re-establish the historical truth. Repeated and generalised debt cancellation has occurred throughout history.

Hammurabi, king of Babylon, and debt cancellation

The Hammurabi Code is in the Louvre Museum, in Paris. The term “code” is inappropriate, because what Hammurabi left us is a set of rules and judgements on relations between public authorities and citizens. Hammurabi began his 42-year reign as “king” of Babylon (located in present-day Iraq), in 1792 BC. What most history books fail to mention is that, like other governors of the City-State of Mesopotamia, Hammurabi proclaimed the official cancellation of citizens’ debts owed to the government, high-ranking officials, and dignitaries. The so-called Hammurabi Code is thought to date back to 1762 BC. Its epilogue proclaims that “the powerful may not oppress the weak; the law must protect widows and orphans (…) in order to bring justice to the oppressed”. The many ancient documents deciphered from cuneiform script have enabled historians to establish beyond any doubt that four general cancellations took place during Hammurabi’s reign, in 1792, 1780, 1771, and 1762 BC.

In Hammurabi’s time, economic, political, and social life were organised around the Temple and the Palace. Those two closely enmeshed institutions, with their numerous artisans, workers, and, of course, scribes, constituted the apparatus of the State, not so very different from today’s governments. The Temple and the Palace provided their employees with board and lodge: they thus received food rations sufficient for two full meals a day. The peasantry was provided with land (which they rented), tools, draught animals, livestock, and water for irrigation, so that they could grow food for the workers and dignitaries. Thus, the peasants produced barley (their staple grain), oil, fruit, and vegetables, a portion of which, when harvested, they had to pay to the State as rent. As well as the land they cultivated for the Palace and the Temple, the peasants owned their own land, home, livestock, and tools. When the harvest was poor, they accumulated debts. They also incurred debt through loans granted privately by high-ranking officials and dignitaries eager to get rich and to seize the peasants’ property in case of default. If peasants were unable to pay off their debts, they could also find themselves reduced to the condition of serfs or slaves; indebtedness could also lead to members of their family being made slaves. In order to ensure social peace and stability, and especially to prevent peasants’ living conditions from deteriorating, the authorities periodically cancelled all debt |1| and restored peasants’ rights.

General debt cancellations in Mesopotamia over 1000 years

Proclamations of general debt cancellation began long before Hammourabi’s reign and continued afterwards. There is evidence of debt cancellation as far back as 2400 BC, six centuries before Hammurabi’s reign, in the city of Lagash (Sumer). The most recent instance dates back to 1400 B.C. in Nuzi. In all, historians have identified with certainty about thirty general debt cancellations in Mesopotamia from 2400 to 1400 BC. Michael Hudson |2| is right to claim that general debt cancellation was one of the principal characteristics of Bronze Age societies in Mesopotamia. Indeed, there are various Mesopotamian words for these cancellations, which wiped the slate clean: amargi in Lagash (Sumer), nig-sisa in Ur, andurarum in Ashur, misharum in Babylon, shudutu in Nuzi.

Such proclamations of debt cancellation were an occasion for great festivities, usually at the annual celebration of Spring. It was during the dynasty of Hammurabi’s family that the tradition of destroying the tablets upon which the debts were inscribed was inaugurated — the public authorities kept a strict record of debts on tablets conserved in the Temple. When Hammurabi died in 1749 BC after a reign of 42 years, his successor, Samsuiluna, cancelled all debts to the State, and decreed that all tablets should be destroyed except those concerning traders’ debts.

The general debt cancellation proclaimed by Ammisaduqa, the last governor of the Hammurabi dynasty who came to the throne in 1646 BC, was very detailed, in a clear attempt to prevent creditors from taking advantage of loopholes. The cancellation decree specified that official creditors and tax collectors who had expropriated peasants should compensate them and return their property, on pain of execution. In cases where a creditor had taken some item of property using pressure, unless he gave it back and/or repaid its worth in full, he would be put to death.

In the wake of this decree, commissions were set up to review all real estate contracts and to eliminate all those which fell under the terms of the debt cancellation proclamation with a view to restoring the prior situation, statu quo ante. The enactment of this decree was facilitated by the fact that the despoiled peasants were usually still working the land, even though it was owned by the creditor. Thus, by cancelling the contracts and making the creditors indemnify the victims, the public authorities restored peasants’ rights. A little over two centuries later, the situation was to change for the worse.

The limits of debt cancellation

In Mesopotamia, during the Bronze Age, debt-slaves were freed, unlike other types of slave such as those seized at war. Nevertheless, this debt cancellation must not be presented as if it were a form of social emancipation. It was merely a way of restoring the pre-existing social order, which was rife with forms of oppression. Without wishing to embellish the organisation of these societies of 3000 to 4000 years ago, it should be noted nonetheless that their rulers sought to maintain social cohesion by preventing the constitution of big private domains, and took measures to ensure that peasants enjoyed direct access to the land. They limited the rise of inequality while overseeing the development and maintenance of irrigation systems. Michael Hudson also insists that any decision to declare war was taken by a general assembly of citizens – the “king” did not have the power to make such decisions alone.

It seems that Bronze Age Mesopotamians did not believe in divine creation as the explanation for life on Earth. The ruler, confronted with chaos, reorganised the world to establish normal order and justice.

No further act of debt cancellation has been found for the period after 1400 BC; inequality increased and intensified. Land was taken over by big private land-owners and debt enslavement became commonplace. A large part of the population migrated north-west towards Canaan, with incursions into Egypt, which displeased the Pharaohs.

The ensuing centuries are known by historians of Mesopotamia as the “Dark Ages”, because of the dearth of written records. However, we do have evidence of violent social struggles between creditors and debtors.

Egypt: the Rosetta Stone confirms the tradition of debt cancellation

The Rosetta Stone, which was carried off by some of Napoleon’s army in 1799 during his Egyptian Campaign, was deciphered in 1822 by Jean-François Champollion. Today, it is in the British Museum in London. Its translation was facilitated by the fact that the Stone bears the same text in three languages: Ancient Egyptian, Egyptian demotic, and the Greek of Alexander the Great’s era.

The Rosetta Stone text confirms that the tradition of debt cancellation was upheld in Egypt by the pharaohs from the 8th century B.C., before Alexander the Great conquered the country in the 4th century B.C. It relates that the pharaoh Ptolemeus V cancelled all debt due to the Throne by the people of Egypt and beyond, in 196 BC.

Despite great differences between the society of Pharaonic Egypt and that of Bronze Age Mesopotamia, there is evidence that both had a tradition of proclaiming amnesty before general debt cancellation. Ramses IV (1153-1146 BC) proclaimed that those who had fled the country could return, and that those who were in prison should be freed. His father, Ramses III (1184 –1153 BC) had done the same. Note that in the 2nd millennium BC there does not seem to have been debt enslavement in Egypt: all slaves were war booty. The proclamations made by Ramses III and Ramses IV concerned the cancellation of arrears on taxes owed to the pharaoh, the liberation of political prisoners and the possibility for those in exile to return home.

Not until the 8th century BC do we find, for Egypt, proclamations of debt cancellation and of liberation for debt slaves. Such a proclamation was made by the Pharaoh Bocchoris (717-11 BC).

One of the fundamental motives for debt cancellation was that the pharaoh wanted at his disposal a peasantry able both to produce plenty of food and to take up arms in military campaigns. For these two reasons, it was important to prevent peasants from being expropriated by creditors.

In neighbouring Assyria, the emperors of the 1st millennium BC also adopted the tradition of debt cancellation, as did the rulers of Jerusalem in the 5th century BC: in 432 BC Nehemiah, no doubt influenced by the old Mesopotamian tradition, proclaimed the cancellation of the debts of all Jews who owed money to their wealthy compatriots. This was at the very time when the Torah was being written. The tradition of general debt cancellation is an integral part of the Jewish religion and of early Christian texts, via the Book of Leviticus, which proclaims the obligation to cancel debt every seven years and on every jubilee, that is, every fifty years.

Conclusion

In the present day, debt repayment has become a taboo subject. Heads of State and of governments, central banks, the IMF and the mass media, all present it as though it were inevitable, unquestionable, and obligatory. Citizens must resign themselves to paying off the debt. The only discussion possible focuses on how to distribute the burden of sacrifice needed in order to free up enough budgetary resources to fulfil the commitments of the indebted nation. The governments who have borrowed were elected democratically, goes the reasoning, therefore their actions are legitimate. The debt must be paid off.

We must pierce the smoke-screen of creditors and re-establish the historical truth. Generalised debt cancellations have been enacted repeatedly throughout history. These cancellations correspond to different contexts. In the cases mentioned above, proclamations of general debt cancellation were made at the initiative of rulers concerned with upholding social peace. In some cases, cancellations resulted from social struggles exacerbated by economic crisis and the rise of inequality. This was the case in Ancient Greece and Rome. Other scenarii can also be envisaged, such as debt cancellation decreed by indebted countries that decide to take unilateral sovereign action, and debt cancellation conceded by a victorious country to a vanquished one and/or its allies. One thing is certain: historically speaking debt has always played a major role in social and political upheaval.

Translated by Vicki Briault and Charles La Via.

notes articles:

|1| Debts between traders were not concerned by these cancellations.

|2| This article is mainly based on the historical synthesis presented by Michael Hudson, doctor in economics, in several fascinating articles and books including: “The Lost Tradition of Biblical Debt Cancellations”, 1993, 87 pages; “The Archeology of Money”, 2004. Michael Hudson is part of a multi-discipline scientific team (ISCANEE, International Scholars’ Conference on Ancient Near Eastern Economies) comprising a number of philologists, archaeologists, historians and economists working on the ancient societies and economies of the Near East. Their findings are published by Harvard University. Michael Hudson approaches this work as an extension of the research carried out by Karl Polanyi. He also produces analyses on the current crisis. See for example “The Road to Debt Deflation, Debt, Peonage, and Neoliberalism”, February 2012, 30 p. Among works by other authors who, since the economic and financial crisis that began in 2007-2008, have written about the long tradition of debt cancellation: David Graeber, “Debt: The First 5000 Years”, Melvillehouse, New York, 2011, 542 p.

infos article

URL: http://www.cadtm.orgEric Toussaint (doctor in political science, president of CADTM Belgium www.cadtm.org, member of the Scientific Council of ATTAC France).

Damien Millet and Eric Toussaint directed the collective work “La Dette ou La Vie”, Aden, CADTM, 2011, which received the Political Book Award at the Liège Political Book Fair in 2011. Most recent publication: Damien Millet and Eric Toussaint, “AAA, Audit, Annulation, Autre Politique”, Le Seuil, Paris, 2012.

http://www.globalresearch.ca/debt-cancellation-in-mesopotamia-and-egypt-from-3000-to-1000-bc/5303136

Forgive All Debt-Push The Reset Button and Fix Our Economy - Student Loans and Mortgages

By Liberty1955 | Posted October 16, 2012 | Watertown, New York 1

Source: http://ireport.cnn.com/docs/DOC-859125

Happy days could be here again! Forgive all personal debt!"Oh, you're crazy, Liberty! No one's going to do that. How would that help anything?"

What would you buy if your FICO score was 825?

What home repair would you finance if you suddenly weren't under water on your mortgage?

In fact, what could you afford to do if you owned your home outright?

Banks created complex ponzi schemes called CDOs and Mortgage backed securities to extract cash from homeowners.

Our economy collapsed, they got bailed out and homeowners got stuck with the bill.

Was this fair?

Banks should cough up the cash that they stole.

And make no mistake, it was stolen. We're not using euphemisms in this report.

Lying is lying not 'exaggerating the truth'.

And stealing is stealing from homeowners by banks. Read Congress's report if you doubt this still.

So give the money back. Push the reset button on debt.

Why should the con men get to keep their rewards?

Early civilizations did just this and it worked well.

We must:

"make certain that capital remain the handmaiden of the state and not fancy itself the mistress of the nation." - Hitler

The international financial system is nobody's friend.

We have to find some way to control it so we can get on with our lives.

Second Millennium Ur may have been an early hothouse of capitalistic enterprise, but what of the borrowers mired in debt?

http://en.wikipedia.org/wiki/Ur

"Governments may actually prefer people in debt.

A study by the economist M. Darling of the rural economy of the Punjab in modern times suggests a disturbing thing about human nature -- people work harder and produce more when they are in debt."

Do countries?

"Darling found that crop yields for farmers in debt typically exceeded yields from unencumbered farmers.

Farmers in the Punjab may have faced foreclosure, but for the ancient inhabitant of Ur, the motivation was even greater.

Debtors were often forced to sell themselves into slavery."

This is where we are now.

"It is difficult to escape the conclusion that, while the first loan contracts and the legal system that enforced them may have been good for the Mesopotamian economy, they made life miserable for the working man and woman.

If lending began, as historian Paul Millet believes, as a process of neighborly reciprocity in rural societies, then it evolved into something quite different.

In Babylonian times, short-term debt was a tool used to extract taxes from the population, and to increase the productivity of temple lands.

It is almost as though the government had found a way to extract the residual "goodwill" from the economy, by allowing individuals to shift financial obligations into the future.

Lending in ancient Ur was mostly for emergency purposes -- where the government created the emergency!

The other side of the coin is that certain entrepreneurs such as Dumuzi-gamil achieved economic upward mobility through borrowing.

Thus, while the system was harsh on the populace, it encouraged creative and productive enterprise.

For those with the imagination to exploit it, the financial system of Ur offered limitless possibilities.

Does this sound familiar? It was more than 3,000 years ago.

The premise of national socialism is that it is possible to get out of this.

The way to get out of the system of debt slavery is to use enthusiasm instead of fear to motivate people."

Hitler was a maniac, a a brilliant strategist whose economic policies lead Germany out of their depression to the most powerful economic country in Europe in four short years. He designed 'national socialism'.

"The Mesopotamian economy was dominated by large public institutions (Temples and Palaces) whose bureaucratic administrators effectively created money of account by establishing a fixed equivalent between silver and the staple crop, barley. Debts were calculated in silver, but silver was rarely used in transactions.

Instead, payments were made in barley or in anything else that happened to be handy and acceptable. Major debts were recorded on cuneiform tablets kept as sureties by both parties to the transaction.

Certainly, markets did exist. Prices of certain commodities that were not produced within Temple or Palace holdings, and thus not subject to administered price schedules, would tend to fluctuate according to the vagaries of supply and demand.

But most actual acts of everyday buying and selling, particularly those that were not carried out between absolute strangers, appear to have been made on credit.

"Ale women", or local innkeepers, served beer, for example, and often rented rooms; customers ran up a tab; normally, the full sum was dispatched at harvest time.

Market vendors presumably acted as they do in small-scale markets in Africa, or Central Asia, today, building up lists of trustworthy clients to whom they could extend credit.

The habit of money at interest also originates in Sumer – it remained unknown, for example, in Egypt. Interest rates, fixed at 20 percent, remained stable for 2,000 years. (This was not a sign of government control of the market: at this stage, institutions like this were what made markets possible.)

This, however, led to some serious social problems. In years with bad harvests especially, peasants would start becoming hopelessly indebted to the rich, and would have to surrender their farms and, ultimately, family members, in debt bondage.

Gradually, this condition seems to have come to a social crisis – not so much leading to popular uprisings, but to common people abandoning the cities and settled territory entirely and becoming semi-nomadic "bandits" and raiders.

It soon became traditional for each new ruler to wipe the slate clean, cancel all debts, and declare a general amnesty or "freedom", so that all bonded labourers could return to their families.

(It is significant here that the first word for "freedom" known in any human language, the Sumerian amarga, literally means "return to mother".)

Biblical prophets instituted a similar custom, the Jubilee, whereby after seven years all debts were similarly canceled.

This is the direct ancestor of the New Testament notion of "redemption".

(Bankruptcy laws used to forgive debt until they were changed to exclude what would hurt banks and governments)

Historically, as we have seen, ages of virtual, credit money have also involved creating some sort of overarching institutions – Mesopotamian sacred kingship, Mosaic jubilees, Sharia or Canon Law – that place some sort of controls on the potentially catastrophic social consequences of debt.

Almost invariably, they involve institutions (usually not strictly coincident to the state, usually larger) to protect debtors.

So far the movement this time has been the other way around: starting with the '80s we have begun to see the creation of the first effective planetary administrative system, operating through the IMF, World Bank, corporations and other financial institutions, largely in order to protect the interests of creditors.

The question is how we can create a countervailing force to oppose this "planetary administrative system."

If we find the will to do what has been done in the past, forgive everyone's debt, we would fix our economy and 'heal the planet'.

Just like when your computer freezes, sometimes the only recourse is to push the reset button.

Or, we can languish in slow growth for the next decade or two.

http://www.geniebusters.org/what-is-national-socialism.htm

Thinking the Unthinkable: A Debt Write Down, and Jubilee Year Clean Slate

Source: http://www.globalresearch.ca/thinking-the-unthinkable-a-debt-write-down-and-jubilee-year-clean-slate/10330

By Michael Hudson

Global Research, September 24, 2008

24 September 2008

Region: USA

Theme: Global Economy

print 56 0 1 193

We have reached the point where it may finally be able to break through the membrane of cognitive dissonance that has been blinded people. The very first course in economics –starting in high school, followed up in college and then refined in graduate school – should explain to students why it is false to believe the advertisement that Wall Street has been trying to sell for the past half century: The deceptive promise that an economy can get rich off the mathematical “magic of compound interest.”

The unreality of this promise should be immediately apparent by looking at the math of exponential growth. Already at the time of the American Revolution, financial economists were popularizing the contrast that Malthus soon would imitate in his population theory: Debts grow at “geometric” rates, while the economy itself grows only “arithmetically,” in a slower and more linear way.

All that is needed is to put this idea together with the basic balance-sheet definition: One person’s savings are lent out to become other peoples’ debts. So the “magic of compound” interest to savers means an equal “magic of exploding debt” to somewhere else in the economy. And inasmuch as creditors insist on protecting themselves from inevitable default by possessing collateral, it is natural that most of the economy’s debts are owed on its largest asset: land and buildings. This explains why mortgage debts have become repayable and “gone toxic.”

The “magic of compound interest” refers to the tendency of savings to double and redouble exponentially, with a matching rise in what debtors owe on the other side of the balance sheet. These mathematics have been operated throughout history, ever since the charging of interest was invented in Sumer some time around 2750 BC. In every known society, the effect has been to concentrate wealth in the hands of people with money. In recent years, one’s own money is not even necessary to do this. The power to indebt others to oneself can be achieved by free credit creation. However, the resulting mushrooming exponential growth in indebtedness must collapse at the point where its interest and other carrying charges (now augmented by exorbitant late fees, bounced-check fees, credit-card costs and other penalties) absorb the entire economic surplus.

This is the point that has been reached – and passed – today. It has been developing for many decades. But there is a great reluctance to accept the fact that debts cannot be paid. “The poor are honest,” as one banker explained to me, and believe that “a debt is a debt” and must be paid. (This is not what Donald Trump, Bear Stearns or A.I.G. believe, but they are at the top of the economic pyramid, not its base.)

Numerous publishers turning down my proposed books on the subject over the years. As they have explained to me: “Nobody wants to read how the bubble will break – at least, not until after it bursts. Can’t you write a book on how you can make a million dollars off the coming economic collapse? That would be a winner, Prof. Hudson. But to tell people that they can’t put aside savings and pay for their retirement ‘in their sleep’ is like telling them that they will have bad sex after the age of 50. It’s a no-seller. Come back when you have good news.”

These are the words I’ve been hearing since the mid-1980s. I’ve spent much of my time looking through history to read up on how the failure to wipe out the debt overhead led to the collapse of Rome’s imperial republic, and to the Ottoman Empire as what was known as “the spoiling of Egypt” and “the ruin of Persia” toward the end of the 19th century. I’ve also published a series of four colloquia by assyriologists and archaeologists describing how earlier, from about 2500 to perhaps 300 BC, Babylonian and other Near Eastern rulers kept their citizens free and preserved their landholdings by annulling personal and agrarian debts when they took the throne – a true “tax holiday” – or when economic or military conditions warranted a general Clean Slate. (The series was funded and published by Harvard’s Peabody Museum and is now available from CDL Press.)

These Clean Slates were adopted literally, almost word for word, in the Biblical Jubilee Year if Leviticus 25. Even the same Hebrew word, deror, was used for the Babylonian andurarum proclaimed by rulers of Hammurapi’s dynasty from 2000 to 1600 BC. So it is remarkable to me that men claiming to be Christian leaders today should ignore the fact that in the very first sermon that Jesus gave, in Nazareth (Luke 4:14-30), he unrolled the scroll of Isaiah 61 and promised that he had come “to proclaim the Year of the Lord,” the Jubilee Year. That was the literal “good news” that the Bible preached, as the Dead Sea scrolls have abundantly illustrated.

Yet it is a sign of the power of creditor ideology that even the essence of this founding document of Western civilization has been ignored by a distorted view of what early Christianity, Judaism and other religions were all about. Hardly surprising. Luke’s passage on this founding sermon of Jesus concludes by pointing out that “all the people in the synagogue were furious when they heard this. They got up, drove him out of the town, and took him to the brow of the hill on which the town was built, in order to throw him down the cliff.”

Down the cliff! This is where the revolting right-wing Roman senators drove the followers of the Gracchi brothers on the Senate hill, in an exercise of political violence that prevented Rome from granting debt relief toward the end of the second century BC. Livy, Diodorus, Plutarch and other historians of the epoch attributed the prospective fall of the Roman Empire to its harsh creditor-oriented debt laws. But today, historians publish books speculating that perhaps the problem was lead piping or lead goblets for their wine, or disease, or imperial overreaching, or superstition – anything but the cause to which the Roman historians themselves pointed.

We are still living with the consequences of Rome’s oligarchic revolution. That is what makes this week’s Congressional hearings on the $700 billion giveaway so important. First with military force and then via debt bondage and serfdom, Rome bequeathed to Europe a property-based, creditor-oriented body of law. But since the 13th century, country after country has shifted the balance back to favor debtors – to save them from literal debt bondage, from debtor’s prisons, from permanent indebtedness, to give them Clean Slates on an individual level.

Handel arranged the first performance of The Messiah as a benefit to raise money to bail debtors out of Irish debtors’ prisons, and every year the oratorio was repeated for that charitable purpose. Martin Luther warned about the mathematics of compound interest as the monster Cacus, devouring all. Yet Luther’s denunciations of usury are excluded from his collected works in English, and are available in this language only in Vol. III of Marx’s Capital and Book III of his Theories of Surplus Value. The discussion of interest and banking has become so marginalized that even when I taught money and banking at the New School in New York City in the late 1960s and early ‘70s, it was not part of the core curriculum but treated as a special topic. (Fortunately, that is not the case where I am now happily situated at the University of Missouri in Kansas City. But it took a long time to get here.)

Behind this shift in legislative choice was the perception that no economy can keep up with the burden of debts growing at exponential rates faster than the economy itself is growing. No economy can grow at steady exponential rates; only debts can multiply in this way. That is why Mr. Paulson’s $700 billion giveaway to his Wall Street colleagues cannot work.

What it can do is provide a one-time transfer of wealth to insiders who already have been playing the debt-credit system and siphoning off its predatory financial proceeds to themselves. The Wall Street bankers, brokers and fund managers to whom I’ve been speaking for many decades all know this. That is why they pay themselves such large annual bonuses and large salaries each year. The idea is to take as much as you can. As the saying goes: “You only have to make a fortune once in a lifetime.” They have been salting away their fortunes year after year, mainly in hard assets: real estate (free of mortgages), fine furniture, boats and trophy art.

Their plan now is for icing on the cake – to take Mr. Paulson’s $700 billion and run. It’s not a “bailout of the financial system.” It’s as giveaway – to insiders, to sell out all their bad bets. Companies across the board will get rid of their bad mortgages, and also their bad car loans, furniture time payments, credit-card loans, student loans – all the debts that any competent actuary could have told them never could have been paid in the first place.

This is not what Treasury Secretary Paulson is acknowledging, and shame on him for it. Last Friday, Sept., he was joined by Fed Chairman Ben Bernanke singing in unison an advertising jingle for America’s new kleptocracy that rings so false that Congress and the American public must hear the off-notes. London’s Financial Times, as well as a host of Europeans realize it. That is what has been driving the dollar’s exchange rate this week. It seems easier for foreigners to recognize the threat to turn American democracy into a rapacious kleptocracy.

This change always is sudden, arranged under emergency conditions. Those with a 12-year memory will see George Bush as playing the role of Boris Yeltsin in Russia in 1996, paying off his campaign contributors by giving them all the economic surplus that the government could expropriate in the notorious “loans for shares” plan applauded and supported by Clinton Treasury Secretary (and current Obama advisor) Robert Rubin. (The moral: do we have a Putin in our near future to lock in the anti-democratic coup?)

How ironic all this is! Back in the 1970s there was theorizing that the Russian and American economies were converging. The idea was that both were moving toward more centralized state control, state financing, state subsidy, and a military-industrial complex. Nobody expected the convergence to occur Yeltsin-style in government giveaways to insiders to create a new group of financial billionaires – the “seven bankers” under Yeltsin in 1996, and Mr. Paulson’s Crony Capitalist gang today.

Let’s look at the euphemisms as an exercise in Orwellian doublethink. Mr. Paulson defended his “troubled asset relief program” (TARP) by claiming that “illiquid mortgage assets … have lost value … choking off the flow of credit that is so vitally important to our economy.” The credit that is “so vitally important” has taken the form of bad loans. Contra Mr. Paulson’s pretense, the problem is not that they are “illiquid.” If that were the problem, it would be merely temporary. The Federal Reserve banks are designed to provide liquidity – on good collateral, of course.

As Financial Times columnist Martin Wolf noted on Wednesday, Sept. 24, the problem is that the face value of mortgage loans and a raft of other bad loans far exceeds current market prices or prices that are likely to be realized this year, next year or the year after that. They are packaged into what the financial press rightly calls “toxic.” The bailout is not efficient, he writes, “because it can only deal with insolvency by buying bad assets at far above their true value, thereby guaranteeing big losses for taxpayers and providing an open-ended bail-out to the most irresponsible investors.”[1] “The simplest way to recapitalise institutions,” He concludes, is “by forcing them to raise equity and halt dividends. If that did not work, there could be forced conversions of debt into equity. The attraction of debt-equity swaps is that they would create losses for creditors, which are essential for the long-run health of any financial system.” This is the key: if debts cannot be paid, then creditors must take losses.

These bad loans are toxic because they can only be sold at a loss – if at all, because foreign investors no longer trust the U.S. investment bankers or money managers to be honest. That is the problem that Congress is not willing to come out and face. Many of these loans are outright fraudulent. And they are being sold by crooks. Crooks who work for banks. Crooks who use accounting fraud – such as the fraud that led to the firing of Maurice Greenberg at A.I.G. and his counterparts at Fannie Mae, Freddie Mac and other companies engaging in Enron-type accounting.

This is not what the magic of compound interest promised. But it is where it had to end up, with mathematical inevitability. It was an advertising come-on for Wall Street money managers and promoters of “pension-fund capitalism” (or “peoples’ capitalism” as it was called in Chile by the Chicago Boys working for General Pinochet’s murderous regime, and Margaret Thatcher’s Conservatives in England). The promise is that if people consign these funds to individuals who make much, much more than they do but have the survival-of-the-fittest advantage of being much, much more greedy, they will receive a perpetual doubling of interest. That is how retirements for American workers are still supposed to be paid – by magic, not by direct investment. Prospective retirees are supposed to ensure a good life by investing savings in loans to corporate raiders who fire, lay off, downsize and outsource these very workers. The trick is to persuade employees to hand retirement funding over to financial managers whose idea was to make money off the economy by extracting interest and dividends off workers, homeowners and companies being bought on debt leverage. In the final analysis it is debt leverage by itself that is supposed to fuel capital gains.

This has led to madness. The maddest solution of all would be for the government to give the extractive financial sector even more money – funds that no private lenders have been willing to provide, not even vulture funds. No private firm has been able to discover what Mr. Paulson and the unfortunate Mr. Bernanke are sanctimoniously promising: that a viable deal, even an almost money-making one, can be made by buying junk now and waiting for “the economy” to make it good.

Just what is “the economy” that is supposed to perform this remarkable feat, if not its mortgage debtors and corporate debtors? The government is to do what law enforcement officials have moved to prevent Countrywide Financial and other predatory lenders from doing: squeezing exploding Adjustable Rate Mortgages and “negative equity” mortgages out of debtors, on terms that often were bait-and-switch to begin with. Private companies could be challenged and their array of penalty fees thrown out of court. But perhaps Congress can craft a law imposing these harsh terms on voters. It is not as if we live in a system where people vote their self-interest.

Promises that “taxpayers” will be able to recover a large part of this money are a fiction. If there were a hope of recovering this money, then investors abroad – foreign buyout funds, foreign banks, foreign sovereign wealth funds – would have been willing to buy Bear Stearns, Lehman Brothers, A.I.G. and other companies at some price. But they wouldn’t touch this at any price.

Why then should the U.S. Treasury pay three times as much as the Iraq War for money that will end up being lost after paying off the gamblers from their own bad bets. These are the bankers who already have placed all the risk onto their clients and, by lobbying to rewrite the bankruptcy laws, onto debtors. As matters now stand, the $700 billion is to be used to finance this year’s annual bonuses, this year’s million-dollar salaries and sales commission, and to contribute yet more to the retirement funds for the golden parachutes that financial managers have siphoned off to provide a safety net for themselves. So we are back to the basic motto these days: “You only have to make a fortune once in a lifetime.” Now is the time to make these fortunes as big as they’re going to get. Because it’s all down hill from here.

Why the banks won’t lend

Here’s why the government giveaway logic is fallacious: It’s a giveaway, not a bailout. A bailout is designed to keep the boat afloat. But the existing Wall Street boat crafted by the investment bankers seeking to unload their junk must sink. The question as it sinks is simply who will be able to grab the lifeboats, and who drowns.

There is a reason why the banks won’t lend: Housing and commercial real estate already are so heavily mortgaged that there is no rental value available (over and above operating expenses, current taxes and debt service) to pledge to the banks. It still costs more to buy a house than to rent it. No increase in the amount of credit, short of hyper-inflation can cure this. No lowering of interest rate, will lead banks to risk making a bad new loan – that is, a loan that probably will go bad and end up with the bank taking a loss after the borrower walks away or defaults.

Does Congress know what it is being told to do? Suppose that “taxpayers” are to squeeze money out of the “toxic” junk mortgages they buy from the investors that have bought these bad loans. The only way to do so would be for real estate prices to be raised to even higher levels. This means an even higher proportion of take-home pay by prospective homeowners.

Mr. Paulson realizes this. That’s why he’s directed Fannie Mae and Freddie Mac to inflate real estate prices all the more. At least, by the existing mortgage-holders to get paid off by existing debtors selling to the proverbial “greater fool.” The hope in Mr. Paulson’s plan is that there are enough “greater fools” with enough money to borrow from yet more foolish new mortgage lenders. Only Fannie Mae, Freddie Mac and the Federal Housing Agency are willing to make such foolish loans, and that is only because they are being directed to act in a foolish way by Mr. Paulson.

Here’s the problem with following Mr. Paulson’s orders and lending yet more: Every major real estate advisor on record has forecast a further drop of between 20 to 30 percent in property prices over the coming twelve months. This is now the standard forecast. It means that over and above the five million arrears and foreclosures that Mr. Paulson acknowledged already are on the books, yet more families are to give up the fight by this time next year. Is the $700 billion giveaway fund to try and recoup by evicting them too from their houses – to pay the “taxpayer” enough to bail out Countrywide, Washington Mutual and other predatory lenders for loans that state Attorneys General have accused of being fraudulent?

For the government to even begin to recover some of the value of the $700 billion in junk mortgages it has bought would force new homebuyers to pay even more of their income to the banks. And if they do that, they will have less income to spend on goods and services. The domestic market will shrink, and tax revenues will fall at the state, local and federal levels. The debt overhead will deflate the economy, causing shrinkage all down the line.

So here’s where the cognitive dissonance comes in: It is necessary, even inevitable, for the volume of debt to come down – not up – to restore equilibrium. The economy was well on its way to preparing the ground for this last week. As Alan Meltzer of the American Enterprise Institute (of all places!) explained on McNeill-Lehrer, Merrill Lynch was able to be sold at 22 cents on the dollar; and the economy survived Lehman Brothers and Bear Stearns being wiped out.

Such debt writes-offs are a precondition for writing down America’s mortgage debts to levels that are affordable. But Mr. Paulson’s plan is to fight against this tide. He wants the Wall Street to keep on raking in money at the expense of the economy at large. These are the big banks who lobbied Congress to appoint de-regulators, the banks whose officers paid themselves enormous bonuses and gave themselves enormous golden parachutes. They were the leaders in the great disinformation campaign about the magic of compound interest. And now they are to get their payoff.

The pretense is that not to pay them off would threaten “the economy.” The reality is that it only would stop their predatory behavior. Worse than that, for the economy at large a government take-over of these bad loans would prevent the debt write-down that the economy needs!

It gets worse. If Congress should be so destructive as to buy out $700 billion of bad loans (for starters), the sellers will do just what Russia’s kleptocrats did. They will take their money and move it abroad to a “hard” currency country. This will help collapse the dollar. Up will go gasoline costs and prices for other imports. America will be turned into a Russian-style post-Soviet economy, having endowed a new domestic kleptocracy of insiders, who use some of their gains to finance the campaigns of American Yeltsins such as McCain.

So let us admit that the economy has been taking a wrong track for a number of decades now. As John Kay noted : “When the dust settles, many banks and hedge funds will have lost more money on their trading activities in the past year or so than they had made in their entire history … The pursuit of shareholder value damaged both shareholder value and the business.”[2]

I worry that Wednesday’s jump in the Dow Jones average signals that the big betters have decided that there is a good chance of the vast giveaway going through. The Republican protests seem to me to aim not so much at really stopping the measure, but on going on record that they opposed it – before they voted for it. When the public wakes up to the great giveaway, the Republicans can say, “It was a Democratic Congress that did it, not us. Read our anguished protests.” Everyone is trying to cover themselves. With good reason.

Don’t let them speak on behalf of voters and then act against the economy, claiming that they are trying to save it. A giveaway of unprecedented magnitude would cripple it for as far as the eye can see.

[1] Martin Wolf, “Paulson’s plan was not a true solution to the crisis,” Financial Times, September 24, 2008.

[2] John Kay, “How we let down the diligent folk at the Halifax,” Financial Times, September 24, 2008.

Sunday, August 2, 2015

Answering Questions You Haven't Asked: Why can't you relax? What's missing at work? What's the most important thing to do at work? How can you do it at work (the most important thing that is)?

Is there any danger to asking or answering questions that haven't been asked?

with the guidance/approval of Einstein, the patron saint of questions:

let's start with the question of questions

why are you thinking about work when you're not at work?

leaving aside the problem of why you can't enjoy yourself when you're not at work

is it because you're the lemon being squeezed at work? asked to do more with less? being rewarded with less?

surveys suggests that many believe they can't let go because they have a smart phone

...and their cell phone acts as a 24/7 electronic leash and that their office is 'walking the dog' and that they're the the working class dog?

surveys also suggest people can't let because they aren't taking their vacations

...and if you just can't seem to find the will take vacation, why?

survey says, its because you think...

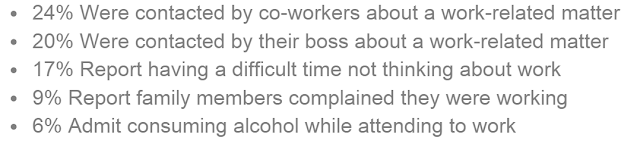

so, if surveys suggest most can't relax when they're not at work

does this mean most are not happy at or about work?

surveys say yes, most don't find full filling and here's why:

so what's the answer? is there a way to make work work better?

so what should pay attention to today and everyday at work (and in your life)? survey says...

Nothing is more important for your happiness (particularly today) than learning how to learn

If we wanted to get Zen about this.....

We might try a work version of a Zen koan such as 'what is the sound of one hand clapping,' but since Bart Simpson pretty much wrecked that one ...

you might think that young grasshopper should ask:

What is the sound of one learner learning at work?

What can Zen can tell you here?

Perhaps that at work, at least, the sound of one learner learning is actually the sound of two or more learners. Confused?