The hubs of advanced manufacturing will be the economic drivers of the future because innovation increasingly depends on production expertise.

By Nanette Byrnes on September 16, 2014

Visitors to the Crosspointe Rolls-Royce facility in Prince George County, Virginia, have to don safety glasses and steel-tipped shoes, just as they would at any traditional factory. But then things start to look different. Past the cubicles filled with programmers and support staff sits a 140,000-square-foot factory with spotless white concrete floors, bright lighting, surprisingly quiet equipment, and very few human beings.

Opened in 2011, Crosspointe is the kind of factory that makes a good backdrop to a political speech about advanced manufacturing, as President Barack Obama knew when he arrived less than a year later. It’s global: the U.S. operations center of a U.K. company, it uses titanium forgings from Scotland, Germany, or the United States; shapes them into fan disks; and, after milling, polishing, and testing, ships them off to England, Germany, or Singapore. Once there, each disk will become one of 10,000 parts in a typical engine.

It’s also highly automated: $1.5 million machines made by DMG Mori Seiki do the initial milling of the disks, following steps directed by Siemens software with a minimum of human interference. On a day in early summer, eight machines were being monitored by three operators. Computer screens in front of the machine displayed instructions in pictures and text, flashing warnings when a part had not met specs or the machine needed to be serviced. Later an automated measurement machine with a probe on the end would spend eight hours inspecting 1,000-plus distinct dimensions of the part. For the next 25 years, Rolls-Royce will keep data on each part, starting with exactly how it was made. Sensors in the engine will track how the engine and its parts are holding up, and maintenance and flight data will be carefully recorded.

It’s not just pristine floors, scarce workers, and a global network that make Crosspointe emblematic of manufacturing today. It’s also the ecosystem surrounding the facility. Just down the road is the Commonwealth Center for Advanced Manufacturing, a research center whose members include Airbus, NASA, and the University of Virginia.

There, Rolls-Royce staff who know the challenges and details of manufacturing work with researchers and suppliers to improve the factory and its products, says Crosspointe manufacturing executive Lorin Sodell. “Often a great idea for a new manufacturing process won’t ever make it into production because that connection is missing.”

Most of the advanced machining and other innovative processes in place at Crosspointe were developed and first tested at a similar research center near the company’s plant in Sheffield, U.K., called the Advanced Manufacturing Research Center. Sodell is already working with suppliers housed in the Virginia research center to diagnose and quickly address new tooling issues and any other problems that might arise.

To understand why manufacturing matters, we must lose some misconceptions. First, manufacturing no longer derives its importance primarily from employing large numbers of people. As software drives more of the manufacturing process, and automated machines and robots execute much of it, factories don’t need as many workers.

Second, the idea popularized in the 1990s and 2000s that innovation can happen in one place (say, Silicon Valley) while manufacturing happens in another (such as China) is not broadly sustainable. If all the manufacturing is happening in China, these networks are growing there, meaning eventually all the innovation—or at least a lot of it—will be happening there too.

Manufacturing will make its most essential economic contribution as an incubator of innovation: the place where new ideas become new products. Thanks to advanced manufacturing technologies, that place can in theory be pretty much anywhere. Robots, software, and sensors work no matter what language is spoken around them. In practice, however, advanced manufacturers thrive best in an ecosystem of suppliers and experienced talent. For this reason, specialized manufacturing networks have taken hold in many regions. Among the success stories highlighted in this report are China’s dominance as a manufacturer of consumer electronics, Germany’s lead in precision tooling and robotics, the United States’ strength in aerospace and car manufacturing, and its role in pushing forward important new manufacturing technologies.

Innovative manufacturing today requires as its base that manufacturers and their suppliers build strong relationships and share knowledge extensively, says Mark Muro, a senior fellow at the Brookings Institution.

China’s achievement is especially significant. Today, it would be nearly impossible for any other region to replicate the country’s manufacturing prowess in electronics or the speed with which its companies can introduce new products, says Harvard Business School professor Willy Shih, a longtime executive at IBM, Eastman Kodak, and other multinational firms who studies the links between manufacturing, product development, and innovation.

It’s not a new idea that manufacturing and innovation are linked. Seventy percent of industrial research and development spending in the U.S. comes from the manufacturing sector. Some have been skeptical, however, that innovation requires manufacturing know-how.

Apple, for example, has thrived with a system of designing its products in California but having them assembled in China using digital design and manufacturing instructions. That arrangement, printed on the back of every iPhone, has been popular with investors who appreciate not only Apple’s wildly successful products but also its “asset light” structure and relatively small workforce. “Couldn’t everyone do what Apple did?” says MIT professor Suzanne Berger, who participated in a three-year-long university task force that examined manufacturing in hundreds of global companies and produced the book Making in America. “In a way, the case that motivated our whole inquiry was Apple.”

Apple did not participate in the study, but in time Berger came to see that the company’s case was not so black and white—that even Apple finds links between manufacturing and innovation. Apple owns the automated production machines in the Chinese factories that manufacture its products. Many California-based Apple engineers spend at least 50 percent of their time in China as new products are launched, she learned.

One engineer explained to Berger that it was critical to be on the ground in China for two reasons: to see what problems arose when the products prototyped in the U.S. hit large-scale production, and to “understand where I left too much on the table, where I could have pushed farther with the design.”

After three years of study, Berger is a believer that the United States must continue to manufacture if it hopes to be an innovation leader. She finds evidence that the manufacturing communities for emerging high-tech sectors such as solar and wind energy and batteries are already being built outside the country in places where technical expertise, manufacturing skills, and even plant layouts are quickly pulling ahead.

Without manufacturing, “we lose capabilities in the workforce,” says Harvard’s Shih. “It limits what you are able to do down the line.”

PART II

Audi Drives Innovation on the Shop Floor

A carmaker’s automated body shop illustrates how German manufacturing is moving forward.

By Russ Juskalian on September 16, 2014

The frame of an A3 sedan sits in the laser brazing chamber at Audi’s Ingolstadt factory, where robots will use a 13-kilowatt diode laser to create an “invisible” seam.

At first, I’m apprehensive about entering the laser chamber. Its 13-kilowatt diodes fire blasts of energy powerful enough to melt metal. At the moment, they are ready to join the roof and wall frame of an Audi A3 sedan. But the engineer at Audi’s plant in Ingolstadt, Germany, insists that I see up close the “invisible” laser-brazed seam about to be made, including a minuscule bend, just five millimeters around, that prevents the car’s body from corroding when exposed to the elements.

The shell of the car sits in the center of the chamber and is surrounded by robotic arms, one of which aims what looks like a soldering iron. The laser brazing process, like much else on the 540,000-square-foot factory floor, is automated and secured behind barriers or within a closed chamber. Later, when I do see people inside the factory, they tend to be pedaling down the long, spotless corridors on red bicycles.

Hubert Hartmann, head of the A3 body shop at Ingolstadt, calls it the most modern factory floor of its kind. “It is like a Swiss watch, with the same level of precision,” he says as machinery whirs nearby with preprogrammed exactness. While most auto plants use robots for welding and other dangerous tasks, Audi marries a high level of automation with a multitude of other advanced manufacturing technologies, including low-power lasers driven by optical sensors; innovative combined bonding and welding, which saves both production time and car weight; and regenerative braking in lift and conveyor systems to reduce energy costs.

At Audi’s A3 body shop in Ingolstadt, the robots are roughly equal in number to the 800 employees. They do most of the heavy lifting, as well as potentially dangerous spot welding and bonding, and tediously repetitive testing. To Bernd Mlekusch, head of technology development production at Audi, the benefits of automation include much higher productivity and reduced demand for untrained workers. At the same time, workers with more training and greater specialization are increasingly needed, he says. German automotive workers, and German manufacturing workers in general, are already paid significantly more than their American counterparts.

Audi’s Hubert Hartmann calls it the most modern factory floor of its kind: “It is like a Swiss watch, with the same level of precision.”

The INTA and group framer machines at Audi exemplify the shift toward automation. INTA, or Ingolstadt automatisierter Anbau, is a fully automated door-assembly process that uses an array of sensors, robotic arms, and lifts. As an A3 body is lowered into place, a sensor determines which version of the car—two- or four-door—is coming down the line. A set of robotic arms then fits hinges to the body while another set picks out the correct doors and prepares to mount those to the hinges. Until 2012, this was done manually, says Carsten Fischer, who is responsible for add-on parts, such as doors, at the plant.

Audi works with KUKA, a leading industrial-robot maker based 84 kilometers away in Augsburg, which in turn works with the Fraunhofer Society, a group of over 60 applied research institutes, jointly funded by industry and the government, whose goal is to facilitate the sort of forward-looking research that a small or medium-sized company might not be able to fund on its own. The innovations that come out of Fraunhofer projects filter back through the whole industry, and experts credit this network of small and large companies and public-private research groups with helping German manufacturing thrive in an era of intense global competition.

The relationships spur innovation but, importantly, also help solidify standards necessary for those innovations to be widely adopted, explains Andreas Müller, who manages RFID technology at Bosch, another company involved in automating factories.

One project Bosch is working on is a German government initiative to use sensors and software to create even smarter factories. The idea is to take the automation in individual processes at a place like Audi’s factory and extend it so that every shipping box, component, and manufacturing station will log and share data, Müller says. Today’s highly automated factories share data mainly within a single process or on a single factory floor—say, between a machine that scans a car to determine its body type and a second machine that selects a tool of the right size for that body type. The government initiative aims to go much further.

The vision is that data from every step of production will not simply pass from one shop to another within a business—such as from Audi’s body shop to its paint shop—but will eventually transit between different partnering companies, optimizing the production process without human input by altering speeds, predicting which components are likely to have been damaged during shipping or tooling, changing the order in which items are built, and reordering parts from suppliers.

Audi’s cars are not entirely built by computers and robots, of course. As I pass by an area where people attach mudguards, rear fenders, and a few other parts, one of the engineers chaperoning my visit explains that some stages of physical production are still worker-intensive, whether because of the size or location of the parts involved or the need to perform certain tasks with a precision that robots aren’t currently able to achieve.

So far the robots can’t do these specialized jobs, the engineer explains, but, he adds, “we’re working on it.”

PART III

Teamwork Will Upend Manufacturing

Robots are starting to collaborate with human workers in factories, offering greater efficiency and flexibility.

By Will Knight on September 16, 2014

Sometime in the next couple of years, if everything goes to plan, workers at BMW’s manufacturing plant in Spartanburg, South Carolina, will be introduced to an unusual new teammate—a robot arm that will roll around handing them tools and parts as they assemble the German carmaker’s luxury vehicles.

Once isolated behind safety fences, robots have already become safe and smart enough to work alongside people on a few manufacturing production lines. By taking over tiresome and repetitive tasks, these robots are replacing some people. But in many situations they are augmenting the abilities of human workers—freeing them to do tasks that require manual dexterity and ingenuity rather than extreme precision and stamina. These robots are also increasing productivity for manufacturers and giving them new flexibility.

BMW introduced robots to its human production line at Spartanburg in September 2013. The robots, made by a Danish company called Universal Robots, are relatively slow and lightweight, which makes them safer to work around. On the production line they roll a layer of protective foil over electronics on the inside of a door, a task that could cause workers repetitive strain injury when done by hand, says Richard Morris, vice president of assembly at the Spartanburg plant. Existing industrial robots could perform this work, and do it much more quickly, but they could not easily be slotted into a human production line because they are complicated to program and set up, and they are dangerous to be around.

While the prospect of increased automation will inevitably cause worries about disappearing jobs, BMW’s Morris can’t foresee a day when robots will replace humans entirely on the factory floor. “Ideas come from people, and a robot is never going to replace that,” he says.

-85% Reduction in workers’ idle time when they collaborate with robots

Still, robots on human production lines at BMW and other manufacturers promise to transform the division of labor between people and machines as it has existed for the past 50 years. The more traditional robots that apply paint to cars, for example, work with awesome speed, precision, and power, but they aren’t meant to operate with anyone nearby. The cost of setting up and programming these robots has helped ensure that plenty of small-batch manufacturing work is still done by hand. The new robots, with their ability to work safely next to human coworkers, let manufacturers automate parts of the production process that otherwise would be too expensive. And eventually, by collaborating with human workers, the robots will provide a way to combine the benefits of automation with those of human ingenuity and handcraft.

Sales of Universal’s robot arms have grown steadily since they first came to market in 2008. Other companies, such as Boston-based Rethink Robotics, are developing similar robotic systems designed to work close to people. Rethink sells a two-armed robot called Baxter that is not only safe but extremely easy to program; any worker can teach it to perform a new task simply by moving its arms through the necessary steps.

-Out of their cage: Robots work alongside humans at BMW’s factory in Spartanburg, South Carolina.

The next generation of robots to work alongside humans are likely to be faster and more powerful, making them considerably more useful—but also necessitating more sophisticated safety systems. These safeguards are now affordable because the sensors and computer power needed to react quickly and intelligently to safety risks have become cheap. In the future robots will also collaborate with humans in far more complicated ways—performing the heavy lifting in an installation job, for example, while the human does the necessary wiring.

BMW is developing its next generation of robots in collaboration with the lab of Julie Shah, an assistant professor at MIT who researches human-machine collaboration. The lab is also working with the aircraft makers Boeing and Embraer. “If you can develop a robot that’s capable of integrating into the human part of the factory—if it just has a little bit of decision-making ability, a little bit of flexibility—that opens up a new type of manufacturing process more generally,” Shah says.

Shah is developing ways for robots to interact intelligently with their human coworkers. At ABB, a Swiss energy and automation company, human and robot teammates swap tasks to learn each other’s preferences, resulting in a process that gets the job done more quickly. Shah has also shown that teams made of humans and robots collaborating efficiently can be more productive than teams made of either humans or robots alone. In her experiments, this coöperative process reduced human idle time by 85 percent.

Workers seem comfortable with the idea of robotic colleagues, too. The latest research from Shah’s lab, in fact, suggests that people collaborating with manufacturing robots prefer to let the robot take the lead and tell the workers what to do next. So the robots on the production line in Spartanburg might someday be upgraded from handing out tools to giving instructions on how to use them.

Source: http://www.technologyreview.com/news/530696/how-human-robot-teamwork-will-upend-manufacturing/

PART IV

The Hunt for Qualified Workers

Employers have 300,000 unfilled manufacturing jobs.

By Kristin Majcher on September 16, 2014

Worried that U.S. workers are ill-prepared to work with new manufacturing technologies like 3-D printing and robotics, President Barack Obama has plans for a national program that over the next 10 years would build 45 hubs where manufacturing companies, community colleges, universities, and government agencies can prepare workers for the factories of the future.

The program underlines a growing concern that gaps in workers’ skills will hinder the current renaissance of American manufacturing. Although employment in the U.S. manufacturing sector dropped steadily from 2000 to 2010, manufacturing has added 646,000 net new jobs over the past four years, according to White House figures.

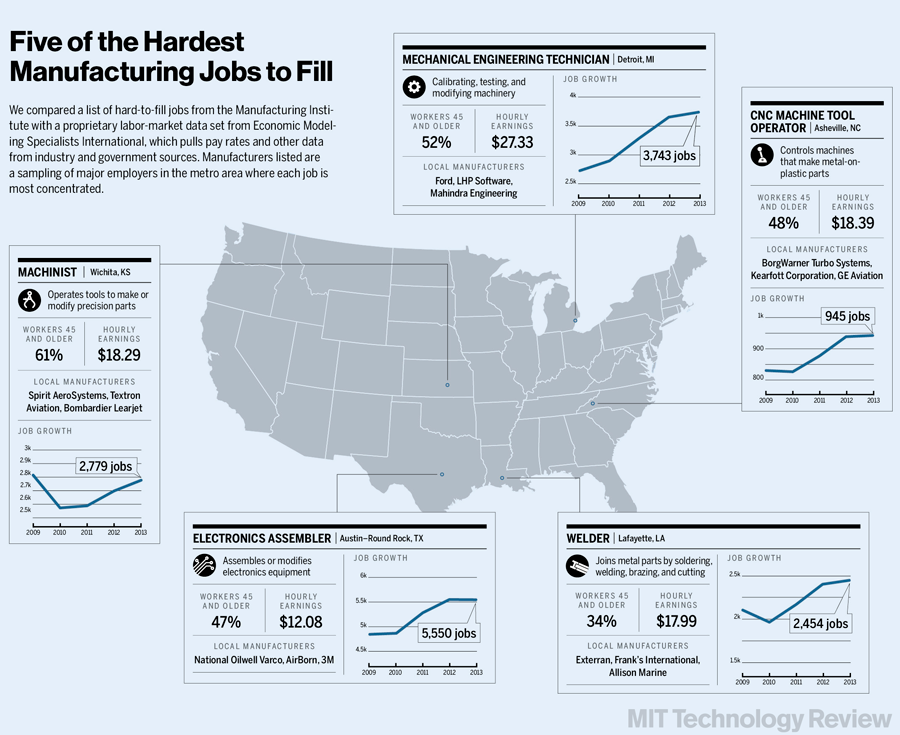

Though many firms are hiring, as of late June, 302,000 manufacturing job openings were unfilled, according to the U.S. Bureau of Labor Statistics. A skills shortage could grow more acute in the next few years. The Boston Consulting Group predicts that by 2020, the United States could face a shortfall of 875,000 highly skilled welders, machinists, machine mechanics, and industrial engineers.

The skills gap seems to be confined to a minority of smaller companies that require specialized skills, according to a 2013 report by MIT’s Production in the Innovation Economy study. The problem is not as pervasive as one might think given how much attention it has received, says Paul Osterman, a professor at MIT’s Sloan School of Management and a member of the commission that conducted the study.

-10.3% Proportion of U.S. employment that comes from manufacturing

Many of the specialized jobs that manufacturers are having the hardest time filling today involve conventional manufacturing tasks. Pipe fitters, mechanical engineering technicians, welders, machinists, electronics assemblers, and operators of computer-numeric-controlled machines are among the most needed workers identified in surveys conducted by the Manufacturing Institute, a nonprofit research affiliate of the Washington, D.C.–based trade association the National Association of Manufacturers.

As workers retire, it’s becoming harder to find people with these traditional skills, says Ben Dollar, a principal in Deloitte Consulting’s manufacturing practice.

For a smaller number of companies, the priority is getting workers up to speed on the skills they’ll need in tomorrow’s factories. In the last 18 months Siemens USA has donated more than $3 billion worth of manufacturing software to colleges in a bid to help train the next generation of advanced manufacturing workers.

Siemens itself plans to hire 7,000 more people in the U.S. by 2020. Their positions will be related to IT, software development, software engineering, and computer science, says Siemens USA CEO Eric Spiegel. "The digital world is coming, and it’s coming very fast," he says. "There will be jobs. People may not count those jobs in IT and software development as manufacturing jobs, but they really are related to manufacturing."

Source:http://www.technologyreview.com/news/530701/the-hunt-for-qualified-workers/

PART V

The New Chinese Factory

Leading manufacturers in China combine the country’s historical labor advantages with expertise in automation, design, and manufacturing.

By Christina Larson on September 16, 2014

Spray coating the surface of a printed circuit board at Flextronics’ Suhong plant in Suzhou, China.

With its medieval canals and carefully preserved downtown, the eastern Chinese city of Suzhou might have been a quiet burgh compared with neighboring Shanghai. But in 1994, the governments of Singapore and China invested in an industrial development zone there, and Suzhou grew quickly into a manufacturing boomtown.

Singapore-based Flextronics, one of the largest global contract manufacturers, built factories there, initially to make small consumer electronics. Those products were relatively simple to assemble in great numbers, making them well suited to China’s then plentiful and inexpensive labor force. But by 2006, labor, land costs, and competition were rising, and Flextronics’ margins were shrinking.

The company refocused its two Suzhou factories on more complex manufacturing, aiming to make higher-priced machines for the aerospace, robotics, automotive, and medical industries. To do so, Flextronics has invested in automation, increasingly precise manufacturing, and improved worker training, all while learning to manage a complicated component supply chain.

Today, these more complex goods make up 72 percent of Flextronics’ Suzhou output. Finished products include printed circuit boards, hospital ultrasound machines, and semiconductor testing equipment so complex each machine requires more than five million parts and retails for $2 to $3 million.

-$600 billion Value of Chinese high-tech exports

It’s a model the Chinese government has pushed manufacturers to adopt, focusing government investment on advanced industries and boosting R&D spending on science and technology. According to data from the U.S. National Science Foundation, between 2003 and 2012 Chinese exports of high-tech products climbed from just over $150 billion to more than $600 billion, making China the largest exporter of such products in the world. Ernst & Young forecasts that by 2022, the country will produce a third of the world’s electrical goods.

On a recent visit to one of Flextronics’ two Suzhou plants, the increasing use of automation is quickly apparent as an automated trolley delivers parts to workers up and down an assembly line, stopping if someone crosses its path. Nearby an LCD wall panel shows the progress of various items moving through quality testing. In the past, workers ticked off boxes on paper forms and entered the results into computer spreadsheets—a time-consuming process fraught with the potential for errors. Now automated data about progress down the assembly line is collected in real time.

Clients can track the data on apps designed by Flextronics. When there’s a disruption due to anything from delivery problems to labor strikes, another app, Elementum, taps into the extensive Yangtze Delta region supply chain, showing customers alternate scenarios for sourcing parts or rerouting production to any of the company’s 30 other mainland plants.

Such services are part of Flextronics’ push to show customers that after years making goods to the specifications of demanding customers like General Electric and Philips, it has more to contribute. Today Flextronics offers its own design and engineering services, consulting on both finished products and ways to improve the manufacturing process.

Flextronics has sometimes expanded its high-end work by going into business with customers. About four years ago, Steven Yang, general manager of one Suzhou factory, led a company investment in a French firm designing a small robot to be used for university research and, potentially, therapy for children with autism. Working from their prototypes, Flextronics designed a manufacturing process that has in six months delivered 1,400 of the robots, which use sonar and facial recognition technology and can be programmed to listen and to speak.

James She, an operation manager in charge of the robot line, says volume has more than doubled since the initial run in the final quarter of 2013, and he expects orders to rise, especially in Asia, where health care and elder care are fast-growing industries. “The robot can be a member of a family in the future,” She says.

Flextronics has pursued automation wherever it has the potential to reduce labor costs and errors. For example, automated optical testing equipment, which checks that the circuitry on printed circuit boards is correct before they are installed in other machines, has cut the number of workers on the inspection line from six to two.

But as product cycles speed up, it doesn’t always make sense to make large investments in robots. Humans are still more flexible. “The time you have to spend changing the machine means it’s not always worthwhile to automate,” says Es Khor, an engineering director at the factory. “When we look for where to automate, we also look for process-specific, rather than just product-specific, tasks.”

So while the French robot line may be creating the health-care assistants of the future, at the moment the robots are being assembled by 28 workers wearing navy blue uniform smocks, mostly young men from rural China. All of them have had at least three months of technical training, and the French company provides performance-based bonuses and organized leisure activities in hopes of reducing turnover and retraining costs. Flextronics has also upgraded its dormitories, built worker break rooms, organized hiking trips and choral groups for employees, and staffed counseling hotlines, all with a view to retaining increasingly expensive, and highly trained, labor.

Twenty-year-old Lan Wenzhi has been working on the robot production line for six months. His job is fastening in tiny screws that hold the battery inside a small box. He has a high school diploma, a smartphone, and a fondness for American movies. His monthly average take-home pay after taxes, including overtime, is about 3,500 yuan (about $570). Factory general manager Yang says that with rising wages in this part of China, labor has increased from about 2 percent of the factories’ costs in 2005 to about 4 percent today. But it’s still relatively small when compared with the 80 to 85 percent of the operating budget spent on materials.

For Yang and Flextronics, the goal is to take advantage of nearly two decades of manufacturing experience to make their factories centerpieces of innovation, not just cheap places to make things.

Source: http://www.technologyreview.com/news/530706/the-new-chinese-factory/

PART VI

Cheap Natural Gas Boosts Manufacturing

Companies that use natural gas as a raw material find the U.S. an increasingly attractive place to be.

By Nanette Byrnes on September 16, 2014

The fastest-growing slice of the U.S. manufacturing sector today is not being driven by automation or cutting-edge robotics but instead by cheap, plentiful natural gas unleashed by fracking shale deposits.

From 2011 to August 2014, the American Chemistry Council, the trade association of the chemical industry, tallied 196 announcements of new chemical plants or upgrades to existing ones in the United States, with investments totaling $124 billion. Huge petrochemical companies such as Saudi Basic Industries, Dow Chemical, and Chevron Phillips Chemical Company are among the investors. Texas is undergoing the largest expansion of petrochemical manufacturing since the 1960s, and other gas-rich parts of the country, including Pennsylvania and the Ohio Valley, are benefiting too.

“Ten years ago everyone was talking about projects in the Middle East,” says Fernando Musa, CEO of Braskem America, a Philadelphia-based subsidiary of the Brazilian thermoplastic resin leader. “Now if you go to industry forums in the U.S., Europe, or Asia, everyone is talking about investing here in the U.S.”

“Ten years ago everyone was talking about projects in the Middle East. Now… everyone is talking about investing here in the U.S.” —Fernando Musa, CEO, Braskem America

Many of these investments are from companies that use natural gas instead of petroleum as a raw material, such as the large petrochemical producers. But cheap natural gas is also offering the prospect of lower electricity costs, which gains the attention of a broad spectrum of manufacturing. The U.S. Conference of Mayors expects employment in energy-intensive manufacturing to grow 1 percent a year through 2020. Steelmaker Nucor has opened a plant in Louisiana that will use natural gas to strip oxygen from iron ore, a classic manufacturing technique that, before the shale boom, had been too expensive for the company to do in the U.S. Tire companies that had largely moved manufacturing to China in recent decades have now announced eight new U.S. plants, including new Bridgestone and Michelin facilities in South Carolina.

U.S. manufacturers could see their energy costs drop by more than $20 billion a year by 2030, according to consulting firm PwC. That could benefit electricity-intensive advanced manufacturing plants, but for many advanced manufacturing facilities the potential savings from cheap electricity are secondary to other considerations.

Samsung Electronics, which operates semiconductor fabrication plants in Austin, Texas, pays close to $60 million a year in electrical bills, says general counsel Catherine Morse, but its recent decision to invest $4 billion mostly in new tooling at the site had nothing to do with electricity prices. Its energy supplier, Austin Energy, relies extensively on solar and wind power, so cheaper gas has a limited benefit for Samsung.

The investment was primarily motivated by an interest in expanding the existing plant’s expertise in logic chips, the chips that control the operation of digital devices. “We do benefit from lower natural-gas prices,” says Morse. “But that’s not driving our investment.”

SOURCE: http://www.technologyreview.com/news/530711/cheap-natural-gas-boosts-manufacturing/

PART VII

Mother Machines

A California factory recently built by Japanese-German firm DMG Mori Seiki makes the case for the future of U.S. advanced manufacturing.

By Robert L. Simison on September 16, 2014

A factory worker drives a forklift carrying a four-ton metal casting across a polished concrete floor. Surrounded by looming robotic equipment, he’s the only human in sight at DMG Mori Seiki’s gleaming machine-tool plant in Northern California.

Three rows of towering, growling machines carve out precision components from rough metal castings weighing anywhere from a few pounds to a few tons. It’s the kind of almost-deserted vista you would expect in advanced manufacturing.

This is the plant’s automated half, but on the other side of a wall with windows, assembly lines swarm with people in white helmets and navy uniforms. There, 40 workers build bedroom-size machines by hand, assembling 2,000 parts to create the computer-driven instruments that will form the hearts of auto, aircraft, and electronics factories across America.

The Japanese call them “mother machines,” because they make other machines possible. Also known as milling machines, they use spinning tools to carve complex shapes out of roughly cast pieces of metal. The results include molds for die casting, gears for transmissions, and cases for smartphones.

14

Days needed to make a DMG Mori Seiki milling machine

The Davis factory builds some of the most advanced computer-numeric-controlled (CNC) milling machines in the world. Fast, durable, and accurate to the micrometer, they are able to move both the cutting devices and the parts they’re shaping in multiple directions. Manufacturers can use DMG Mori tools to make more products, make them faster, and use less energy over longer periods of time.

The quality and productivity of the Davis machines put them “at the upper end of the industry,” says David Dornfeld, chair of the mechanical engineering department at the University of California, Berkeley.

DMG Mori’s decision to build the $50 million factory in Davis says important things about the future of U.S. manufacturing, according to Dornfeld. As automation makes labor costs less important, producers of everything from smartphones to artificial knees to electric cars are increasingly able to choose local production, he says.

Among the key advantages of locating in California: the factory is closer to customers—not trivial when shipping products that weigh tens of thousands of pounds—and to the company’s innovation center and local university research partners. Building some of its machines in the United States also insulates the company from losses on currency exchange and has helped to improve its sales, profits, and share of the U.S. market. The United States now accounts for 25 percent of DMG Mori’s global sales.

The tidy white-and-gray DMG Mori plant sits unobtrusively next to Interstate 80. Flatbed trucks carrying its 20,000-to-40,000-pound products can take the road west to Silicon Valley or east to auto, aircraft, and oilfield-equipment factories. A map in the assembly hall sprouts tiny white, yellow, navy, and orange flags representing the products’ destinations.

The factory grew out of a relationship between the company and the engineering school at the University of California, Davis, according to Zachary Piner, general manager of the plant’s technology department. The company established its Digital Technology Laboratory in Davis in 2000. Piner and the factory’s managing director, Adam Hansel, were completing graduate degrees when they were hired as two of the first four employees.

“For this combination of software, hardware, and precision manufacturing, companies need proximity to educational infrastructure,” says Enrique Lavernia, the dean of the Davis engineering school. “This high-value manufacturing of sophisticated technology is an opportunity for us in this country.”

One reason for placing the factory on the same site was to capitalize on this talent, Hansel says. With more than 60 engineers, the center designs machine tools and software for DMG Mori worldwide. One smartphone app they designed enables customers to monitor their machines, displaying red, yellow, and green lights next to tiny images of the devices to show their operating status.

The laboratory’s engineers also helped design and set up the factory itself, inventing fixtures for use in product assembly and developing software for the automated lines. Now the laboratory uses the factory to test next-generation prototypes.

Inside the plant, steel-reinforced floors are 40 inches thick to prevent vibrations. The air is almost odorless and free of dust, an enemy of precision and a safety hazard as well. There’s so little noise that people can converse without raising their voices.

Two workers operate a crane to load castings onto the machining system. Six hours later, the parts emerge with precise grooves, tracks, threaded bolt holes, and other shapes carved into them. A system designed by the Digital Technology Laboratory uses yellow robotic arms to vacuum up metal shavings and chips.

Machines verify quality at every step. As parts enter the assembly hall, they go through a $1 million coördinate-measuring station that’s accurate to within four micrometers.

The factory goes months without a quality problem, Hansel says. Half of the factory’s products go to small parts-making shops with 50 workers or fewer. They can’t afford malfunctions on machines that anchor their production and cost $120,000 to $500,000. White-shirted quality-assurance workers conduct 100 hours of rigorous tests at various stages of assembly, Hansel says.

Starting with the foundation casting, workers attach major subassemblies that hold the moving parts. They add electrical controls and wiring, hydraulic pumps and piping, and sheet-metal covers. From start to finish, the whole process takes 14 days. There are usually 30 machines under construction at a time.

On one machine, Jeff Gagne installs a shiny rotary table machined on the other side of the plant. He connects the electrical controls and uses sensors to verify that the table is square to the machine’s spindle, which spins cutting tools.

Like the other assemblers, Gagne rolls a cart with a rack of hand tools from machine to machine. There are torque wrenches, box-end wrenches, socket wrenches, and Allen wrenches. Small abrasive stones that can shave off tiny layers of metal are there, too. “About 20 strokes will remove a micron,” Hansel says. “There’s an art to it.”

The DMG Mori plant has about the right balance between automation and assembly by hand, UC Berkeley’s David Dornfeld believes.

“It would be crazy to try to build a machine tool with robots,” he says. “This is instrument-making, and each machine does have its own personality.”

Source: http://www.technologyreview.com/news/530716/mother-machines/

PART VIII

How to Build 3-D Printing

One of the most promising new manufacturing technologies still faces big hurdles.

By Kristin Majcher on September 16, 2014

3-D printing—or additive manufacturing, as it is sometimes called—builds parts by depositing layers of metals, thermoplastics, and even ceramics in a design dictated by a computer file. The technology, which can create complex things that are difficult to manufacture traditionally, has been used to print highly customized products like hearing aids and parts for airplane engines.

It is already well accepted by a few companies. Align Technology uses it to make Invisalign dental braces designed for individual patients, and the aerospace industry uses additive manufacturing to create some high-tech parts. General Electric, one of the world’s largest manufacturers, has developed a 3-D-printed fuel nozzle made from a mix of cobalt, chrome, and molybdenum. Included on our 2013 list of 10 Breakthrough Technologies, it has fewer parts and is 25 percent lighter and five times more durable than previous nozzles, the company says.

But beyond these few early adopters, the technology’s appeal has been limited by its high cost and slow speed. For 3-D printing to become more widely used, the overall process will need to be cheaper, and the machines will need to be redesigned to make it faster and support a wider array of materials.

“It is still a market that is quite expensive,” says Dominik Rietzel, an additive-technologies specialist at BMW Group Research and Innovation Center in Munich. While 3-D printing can save on the amount of material needed to make a part, preparing and formulating materials for the machines can be expensive, and the results are not always consistent. As a result, traditional injection molding remains more economical for high-volume part production, says Rietzel. BMW, which has invested substantially in 3-D-printing metals and plastics since buying its first additive-manufacturing machine in 1989, uses the technology for rapid prototyping and to validate manufacturing processes for new car designs, not to mass-produce parts. The cost of the machines and materials would need to be reduced “significantly” before the company would consider that, according to the automaker, which made more than two million cars last year.

35%

Share of 3-D-printed goods that are commercial parts

Researchers are working to reduce the expense of getting bulk metals and plastics into a form that can be processed with a 3-D printer. Others hope to find ways to eliminate the need to change their form.

Metalysis, based in Rotherham, U.K., says it has developed a way to significantly reduce the cost of 3-D printing with titanium, which is valued for its light weight and strength. Unlike traditional machining, which can use titanium in its natural state, additive manufacturing requires the metal to be turned into a powder. That process is expensive. Using a method based on research from the University of Cambridge, Metalysis is able to create titanium powder for as little as 25 percent of the cost of the usual process.

The U.S. Department of Energy’s Oak Ridge National Laboratory, in Tennessee, is working to develop a machine that can print with high-performance plastics already commonly used in traditional manufacturing. A gantry-style machine, which could be commercialized as early as 2015, uses thermoplastic pellets reinforced with glass and carbon fiber. Widely used in the injection molding industry, these pellets cost just $1 to $10 per pound, and the Oak Ridge printer can use them to produce things as diverse as affordable tooling and unmanned aerial vehicles. There is an added benefit: testing has shown that putting these materials through an additive-manufacturing process actually makes them stronger and stiffer by aligning the carbon fibers, says Lonnie Love, a research scientist at the lab.

Besides cost, speed is another obstacle 3-D printing must overcome to be useful in mass production. The systems still generally make parts at only about one cubic inch per hour, says Love, which means it could take days or weeks to make a part the size of a shoebox. But the new machine from Oak Ridge will be able to print parts 200 to 500 times faster. The downside: the surface finish suffers, and parts must go through a traditional machining process to give them their final look.

Google’s Project Ara, which plans to print customized cell-phone parts by 2015, is also pushing for speed. Its supplier, 3D Systems, the first maker of a commercial 3-D-printing machine, has rethought its basic approach. Its new printing process involves an assembly line on which parts move around a track and are built up by fixed print heads above. 3D Systems says this approach has already beaten injection molding speeds.

Beyond speed and cost, manufacturers face one more challenge: perfecting the composition of the materials to give them the strength and versatility needed for industrial applications. NASA’s Jet Propulsion Laboratory in Pasadena, California, working with the California Institute of Technology and Pennsylvania State University, is using lasers to melt metal powders to form alloys that are then deposited onto a rotating rod layer by layer. The process could allow manufacturers to switch between two different alloys during production and make parts from more than one metal.

“We’re learning how all the interactions of machine and material play together, how they form not only the shape but also the properties,” says Christine Furstoss, GE’s manufacturing and materials technology director.

“Forming the properties at the same time you’re making a shape—it’s something that took the forging and casting industry decades to figure out,” Furstoss adds. “We’re trying to do it in years.”

Source: http://www.technologyreview.com/news/530721/how-to-build-3-d-printing/

PART IX

A Closer Look at Breakthrough Factories

Industry resources, upcoming events, and more data.

By MIT TR Editors on September 16, 2014

OUTSIDE READING

Suzanne Berger, writer

OUTSIDE READING

Suzanne Berger, written testimony for the Senate Committee on Banking, Housing, and Urban Affairs Subcommittee on Economic Policy, December 2013.

In her testimony for a Senate subcommittee on economic policy, MIT political science professor Suzanne Berger explains how findings from the Institute’s sweeping study “Production in the Innovation Economy” show that manufacturing is the key to commercializing innovations in the United States. Berger highlights key survey results, including the finding that some of the most innovative firms in the U.S. are having trouble securing domestic funding to produce their products at scale, requiring them to seek financing abroad. More information related to the study appears in two books, Making in America, by Berger, and Production in the Innovation Economy, a compilation of related academic research.

Erik Brynjolfsson, Andrew McAfee, and Michael Spence, “New World Order,”Foreign Affairs, July/August 2014 This trio of academics argues that “advances in technology have created an increasingly unified global marketplace for labor and capital” and that the distinguishing characteristic of the most successful firms and national economies is rapidly becoming innovation. While the U.S. is recognized as an incubator of new ideas and entrepreneurs, they argue, that situation is not guaranteed to continue.

Scott Andes and Mark Muro, “China: A Manufactured Chimera? Part Two,” Brookings Institution, May 2014. Breaking down earlier research on the component costs of an iPhone, the authors argue that it’s not China that’s cashing in on the manufacture of this American innovation but, rather, certain other developed nations, including Japan, South Korea, and Germany, which have become “masters of advanced manufacturing” and are making the phone components with the highest price tags.

PricewaterhouseCoopers, “3D Printing and the New Shape of Industrial Manufacturing,” June 2014

Although there is substantial buzz around 3-D printing and what it can do, this survey of more than 100 manufacturers makes it clear that while many companies use the technology in some way, the majority are still figuring out what to do with it. Some 33 percent of the firms say they think it is “very unlikely” that 3-D printing will be used for high-volume production in the next three to five years. Even so, the authors predict that the market for 3-D printers will reach $6 billion by 2017, and they highlight some promising innovations in machines and materials that will open up more options for deploying the technology.

Accenture, 2014 Manufacturing Skills and Training Study, May 2014 Shortages of skilled labor cost manufacturers up to 11 percent of their earnings each year, according to consulting firm Accenture’s report on the manufacturing workforce. In addition to statistics on labor shortages, this study, which was based in part on a survey of more than 300 executives at U.S. manufacturing firms, highlights things firms can do to improve their staffing, such as taking advantage of apprenticeships and rethinking the skills they require of candidates. The shortage could become more acute soon. Some 82 percent of the U.S. manufacturers surveyed reported that they plan to increase production in the coming years.

President’s Council of Advisors on Science and Technology, Report to the President on Capturing Domestic Competitive Advantage in Advanced Manufacturing, July 2012. This report offers insight into President Obama’s push for a national network of manufacturing hubs that focus on advanced technologies like lightweight materials and additive manufacturing. The advisory committee, cochaired by former MIT president Susan Hockfield and Andrew Liveris, chairman and CEO of Dow Chemical, recommends that the United States take several actions in order to be more competitive, including forming these hubs so that large and small manufacturing companies, community colleges, and universities can work together to foster innovation.

Fernando D. Sedano, “Latin American Manufacturing Outlook: Mexican Factories to Lead Growth While Brazil’s Manufacturers Falter,” July 2014. This latest edition of a biannual report published by the Manufacturers Alliance for Productivity and Innovation forecasts that the fastest-growing industries in Latin America will make motor vehicles, electronics, metals, and transport equipment. The project predicts better days for the Mexican manufacturing sector but suggests that Brazil may have a more difficult time expanding manufacturing, owing to problems with infrastructure

FROM THE ARCHIVES

“Made in America, Again,” January 2013. In an interview with Harry Moser, head of the Chicago-based Reshoring Initiative, Antonio Regalado explores whether it makes sense for manufacturers that have shipped jobs to China to bring work back to the U.S. The interview is part of “The Next Wave of Manufacturing,” a business report on advanced manufacturing that looked at the important role technology would play in a manufacturing environment of rising wages in China and cheap domestic energy in the U.S.

“The Difference Between Makers and Manufacturers,” January 2013. In his review of Chris Anderson’s book Makers: The New Industrial Revolution and of Producing Prosperity: Why America Needs a Manufacturing Renaissance, by Harvard professors Gary P. Pisano and Willy C. Shih, David Rotman finds some clever ideas about how to produce things coming from the “maker” movement 3-D printing has inspired but little evidence that the movement is revolutionizing the manufacturing industry.

“Why Google’s Modular Smartphone Might Actually Succeed,” April 2014. In this feature, David Talbot takes a look inside Google’s Project Ara, which aims to have customized 3-D-printed parts in the hands of consumers by 2015. Noting that modular hardware has been tried unsuccessfully in the past, he asks whether the smaller and cheaper hardware of today could be enough to make Project Ara succeed.

“Increasingly, Robots of All Sizes Are Human Workmates,” April 2014. Manufacturers are planning for a new type of employee on the factory floor: robots. Is the idea of humans and machines working harmoniously together just science fiction? Will Knight examines some of the new additions to the manufacturing workforce and talks to the companies at the forefront of the movement toward human-robot cooperation.

DATA LINKS

U.S. Census Bureau: Manufacturers’ Shipments, Inventories & Orders. This survey logs the monthly shipments and new orders of select U.S. manufacturers, providing unadjusted figures as well as figures adjusted for seasonal factors. New orders increased to $558.3 billion in July.

Manufacturers Alliance for Productivity and Innovation: Manufacturing Charts. This U.S. trade organization’s data allows users to find economic information tailored to a specific industry or part of the world.

U.S. Bureau of Labor Statistics: Industries at a Glance, Manufacturing The BLS offers tables on job openings, earnings by occupation and more. Information on various subcategories of manufacturing is also provided. The tables, which are updated every month, include some preliminary data.

Federal Reserve Bank of St. Louis: All Employees: Manufacturing An interactive graph contains employment data collected by the U.S. Bureau of Labor Statistics from 1939 to today. Users can manipulate the graph to spot employment trends across the manufacturing industry and adjust the starting and ending years.

Source:http://www.technologyreview.com/news/530726/a-closer-look-at-breakthrough-factories/

No comments:

Post a Comment